Today there are 73 different account reconciliation software. We spent 87 hours comparing the top 50 to find the seven best you can use to ensure your bank transactions are in line with your accounting records.

What is the Best Account Reconciliation Software?

- ZarMoney — best of the best

- Sage Intacct — best for small businesses

- QuickBooks Online — best for entrepreneurs

- AutoRek — best for enterprises

- Blackline — best for automation

- Xero — best for midsize businesses

- Dolibarr — best free alternative

1. ZarMoney

Our Verdict — Best Of The Best

Price: Starts at $15/month

ZarMoney is an extra user-friendly accounting solution for businesses that need to streamline their account reconciliation process. We think it’s the best because of its automated collection process, seamless bank connections, and insightful financial reporting.

The Best Part:

Insane integration capabilities. ZarMoney’s seamless bank syncing feature supports over 9,600 financial institutions and banks in the US and Canada.

The Worst Part:

Additional users come at a cost. ZarMoney charges you $10/mo for any extra users you add to your account.

Get it if you need a user-friendly accounting solution to detect discrepancies between your transactions and accounting records.

I recommend you start with the 15-day free trial, then sign up for the Small Business plan for $20/month.

(15-day free trial)

Best For

ZarMoney is best for businesses that need a user-friendly account reconciliation solution.

Top Features

- Comprehensive financial reporting. Get a holistic view of your accounts receivable data with tailor-made dashboards and in-depth receivable reports, balance sheets, and profit & loss statements.

- Auto-balancing entries. Save precious time by allowing ZarMoney to automatically adjust received amounts, streamline billing, and offer a crystal-clear view of cash flows for easy reconciliation.

- Smart collection process. Streamline receivables, set up partial and complete payment reminders, and reconcile statements with just a few clicks.

- Native software integrations. Connect ZarMoney with essential business tools such as Shopify, Stripe, and Zapier.

- Multi-user support. Collaborate effectively with team members and assign specific roles and permissions for each user.

Pricing

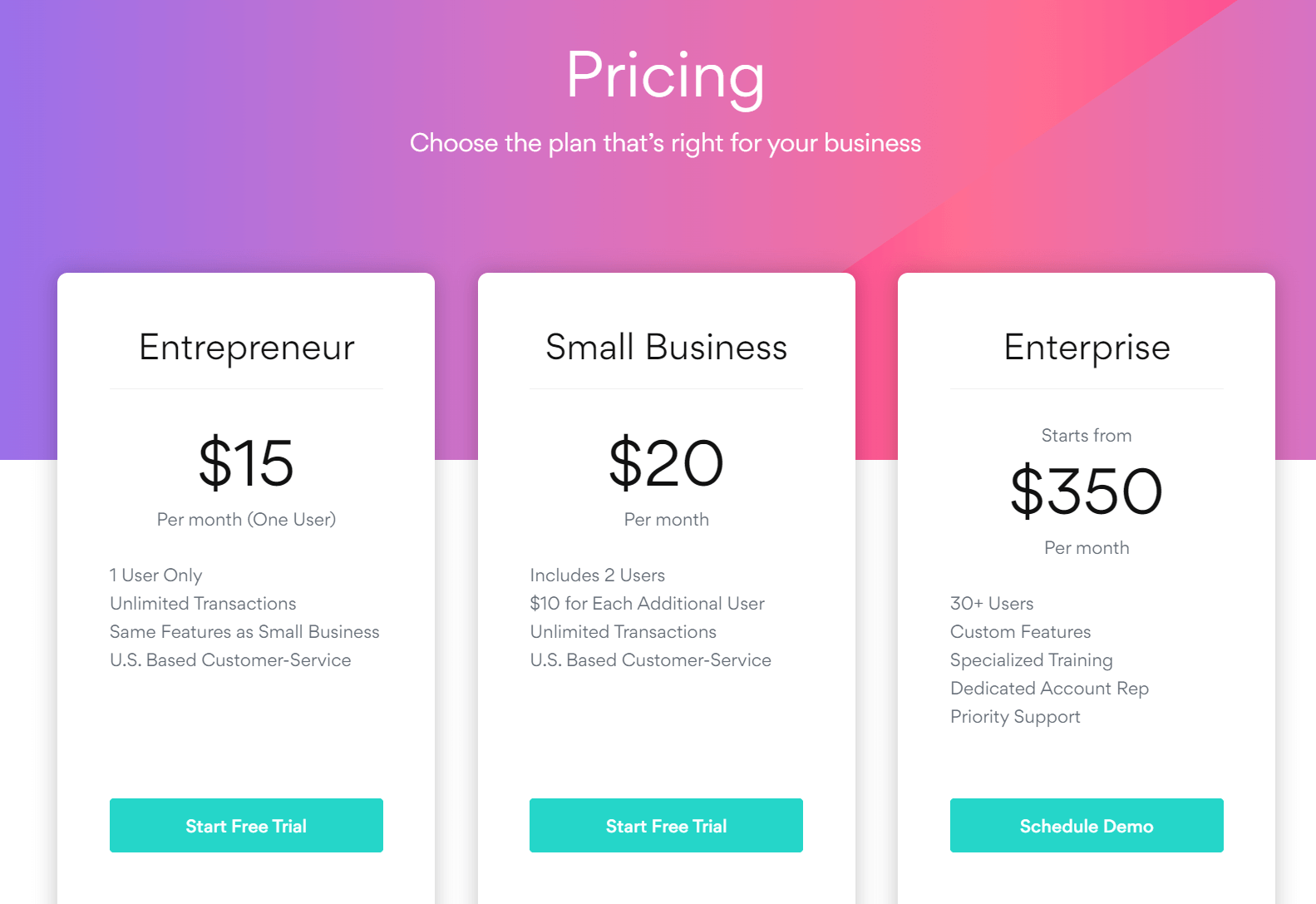

ZarMoney offers three pricing plans:

- Entrepreneur: $15/month for solo users who need a reliable account reconciliation solution for unlimited transactions and a US-based customer support team.

- Small Business: $20/month for small businesses that need a reliable account reconciliation solution for up to two users.

- Enterprise: $350/month for growing businesses with 30 users or more that need a robust account reconciliation and accounting solution with a dedicated account rep, priority support, and dedicated training.

Try ZarMoney today with a free 15-day trial

2. Sage Intacct

Our Verdict — Best For Small Businesses

Price: Custom

Sage Intacct is an advanced accounting solution for small businesses aiming to optimize their account reconciliation. We think it’s the best for small businesses because of its automatic transaction matching, real-time cash insights, and swift transaction matching.

The Best Part:

It integrates with your bank. Sage Intacct connects with over 10,000+ banks worldwide to sync and reconcile your transactions in real-time.

The Worst Part:

Steep learning curve. Sage Intacct can be challenging to get the hang of, at first.

Get it if you want an advanced accounting tool to streamline account reconciliation and integrate unlimited bank accounts.

I recommend you book a call with Sage Intacct’s sales team.

(book a call)

Best For

Sage Intacct is best for small businesses that need an advanced accounting solution to thoroughly manage their account reconciliation.

Top Features

- Say goodbye to manual entries. Populate and reconcile financial data automatically from journal entries or credit card transactions into Sage’s accounting system.

- Missing transaction management. Sage Intacct detects and creates missing credit card transactions, so you don’t have to.

- Automatic transaction matching. It matches invoices to customer payments from different payment processors or banks.

- Fraud detection. Use Sage Intacct's smart fraud detection functionality to catch exceptions in your system, handle bank errors, and watch out for possible fraud.

- Cash is king. Process customer payments fast and prevent payment failures, to keep the cash flowing in your accounts.

Pricing

Sage Intacct offers a single pricing plan:

Custom pricing: Custom price, for small businesses that need an advanced financial management solution to reconcile financial records and detect fraud.

Try Sage Intacct today with a free demo.

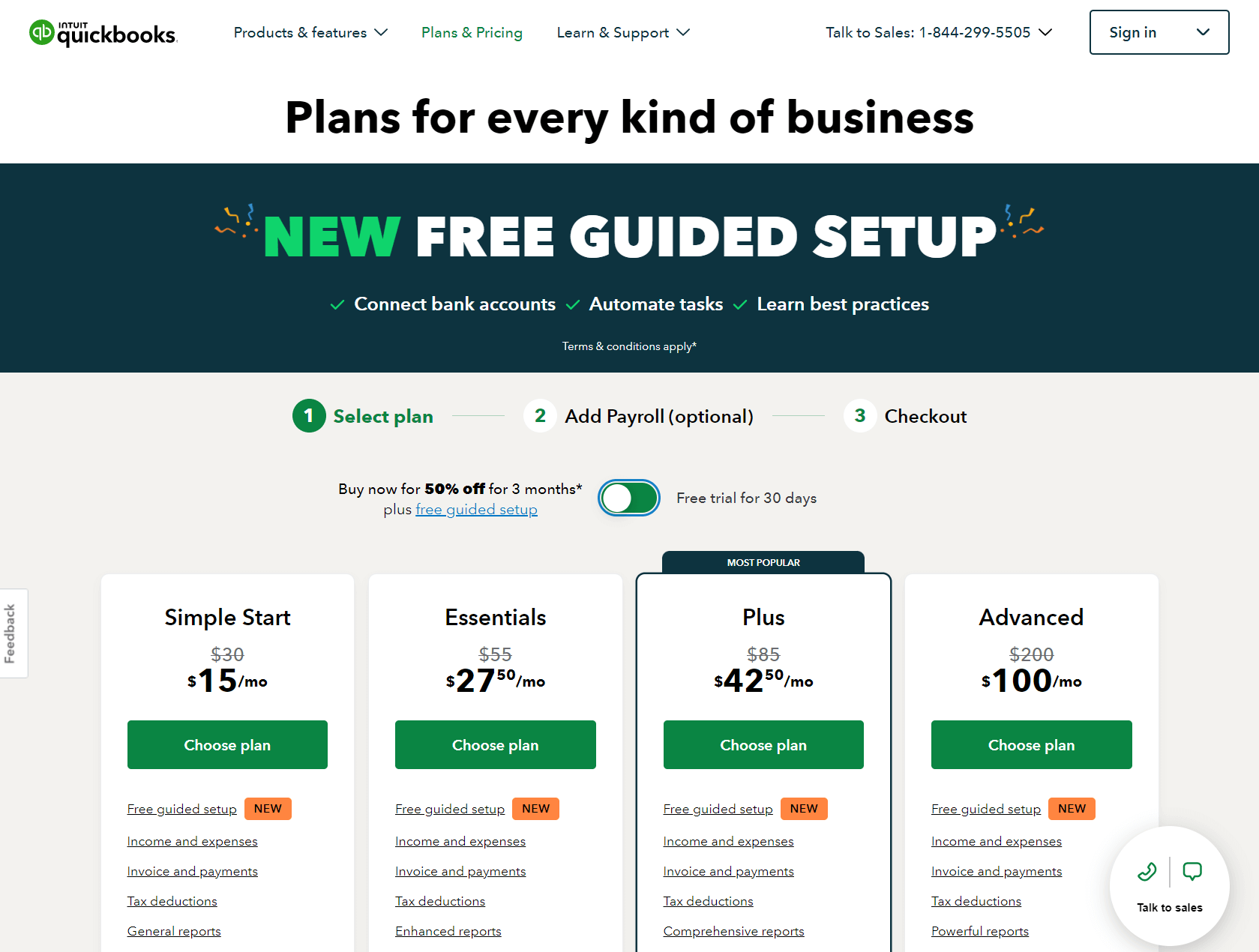

Our Verdict — Best For Entrepreneurs

Price: Starts at $15/month

QuickBooks Online is a robust accounting solution for entrepreneurs who get their hands dirty. We think it’s the best for entrepreneurs because of its automatic transaction import, sleek mobile app, and robust financial reporting.

The Best Part:

Wide range of integrations. QuickBooks Online has more integrations than any other tools in the market, ranging from online store integrations to banks and payment processors.

The Worst Part:

Limited customization options. QuickBooks Online doesn’t provide the necessary flexibility for businesses with particularly complex account reconciliation requirements.

Get it if you want a reliable account reconciliation solution to integrate with your tools and bank accounts to generate comprehensive financial reports.

I recommend you sign up for the Essentials plan at $27.50/month.

(30-day free trial)

Best For

QuickBooks Online is best for entrepreneurs who need a powerful account reconciliation solution that’s easy to use.

Top Features

- Unlimited bank account syncing. Connect unlimited bank accounts with QuickBooks to streamline your account reconciliation with real-time transaction updates.

- Multi-channel sales integration. Sync sales from multiple sources and payment processors to reconcile all records in one spot.

- Snap and store receipts. Take pics of your receipts with your phone, and QuickBooks logs your expenses automatically.

- Customizable invoicing. Put your best foot forward with personalized invoices to reflect your brand and make a lasting impression on your clients.

- Comprehensive financial reporting. Get a bird’s eye view of your business’ finances with QuickBooks’ easy-to-read data reports.

Pricing

QuickBooks Online offers four pricing plans:

- Simple Start: $15/month for the first year, then $30/month for entrepreneurs who need a basic account reconciliation solution with features for tracking income, expenses, and tax deductions.

- Essentials: $27.50/month for the first year, then $55/month for entrepreneurs and businesses looking for a complete account reconciliation solution with bill management, time tracking, and seamless integration for up to three sales channels.

- Plus: $42.50/month for the first year, then $85/month for entrepreneurs and businesses looking for a robust account reconciliation solution with inventory management, project profitability tracking, and seamless integration for unlimited sales channels.

- Advanced: $100/month for the first year, then $200/month for entrepreneurs and businesses looking for an advanced accounting solution with robust reporting, workflow automation, data restoration, and seamless integration for unlimited sales channels.

Try QuickBooks Online today with a free 30-day trial.

Our Top Three Picks

Here’s a quick summary of our top three picks:

- ZarMoney — best of the best

- Sage Intacct — best for small businesses

- QuickBooks Online — best for entrepreneurs

Here’s a quick comparison of our top seven picks:

Tool | Entry Offer | Pricing |

|---|---|---|

ZarMoney | 15-day free trial | Starts at $15/mo |

Sage Intacct | Free demo | Custom |

QuickBooks Online | 30-day free trial | Starts at $15/mo |

AutoRek | Free demo | Custom |

Blackline | Free demo | Custom |

Xero | 30-day free trial | Starts at $25/mo |

Dolibarr | 30-day free trial | Starts at $13/mo |

Here are the top 50 account reconciliation software we considered in this review:

- ZarMoney

- Sage Intacct

- QuickBooks Online

- AutoRek

- Blackline

- Xero

- Dolibarr

- Upflow

- ReconArt

- OneStream

- Cube

- Multiview ERP

- MIP Fund Accounting

- NetSuite

- Serenic Navigator

- AccuFund Accounting Suite

- Blackbaud Financial Edge NXT

- BOARD

- Deltek Vision

- Accurants

- Sparkrock

- Patriot Accounting

- Divvy

- Banyon Fund Accounting

- Datarails

- QuickBooks Desktop

- Stripe Billing

- DataServ SaaS AP Automation

- Chargebee

- Gravity Software

- NCH Software

- Redwood

- EASYGST

- Firmway

- Gresham

- Recosso

- enReconcile

- Cashbook

- Adra Accounts

- Statement Matching

- Traverse Distribution

- Sigma Conso

- SkyStem

- Flare

- Sheetkraft

- Vin Reco

- SmartRecon

- XREC

- Onex Recon

- Lendio

What is account reconciliation software?

Account reconciliation software refers to tools and platforms designed to help businesses automate and streamline the process of reconciling financial statements, bank statements, accounts payable, accounts receivable, and other financial records.

These software solutions use advanced algorithms, data-matching techniques, and intuitive interfaces to simplify and improve the accuracy of the reconciliation process.

What software is used for reconciliation?

Some popular reconciliation software options include ZarMoney, Sage Intacct, QuickBooks Online, and other specialized tools like Bank Rec.

These platforms offer features such as automation, unlimited users, audit trails, and advanced reconciliation workflows that cater to the unique needs of businesses across various industries. By using these software solutions, businesses can achieve more accurate reconciliations, reduce the chances of errors, and enhance overall financial processes.

What is the best way to reconcile bank accounts?

The best way to reconcile bank accounts is to use a systematic approach that combines advanced reconciliation software with proper internal controls and adherence to financial processes. This ensures accurate reconciliations while minimizing the risk of errors and human intervention.

By leveraging software solutions such as bank reconciliation software and accounting software with intuitive interfaces, business owners and their finance teams can efficiently manage the reconciliation process. The level of automation provided by these tools reduces manual processes and the volume of transactions, leading to improved financial records and real-time insights for better financial planning.

Additionally, the integration of enterprise resource planning (ERP) systems and other accounting applications can streamline the entire process, allowing for a more user-friendly experience and increased accuracy using internal records.

What software is used for bank reconciliation statements?

Several software solutions are available for bank reconciliation statements, including ZarMoney, Sage Intacct, and QuickBooks Online. These platforms offer a range of features, such as intuitive interfaces, unlimited users, audit trails, and advanced features that help streamline the accounts reconciliation process.

With user reviews and customer support options, these tools can be tailored to the unique needs of businesses of all sizes. By automating the matching process and providing advanced reconciliation workflows, these platforms can significantly reduce the chance of errors and improve overall financial processes.

Can you automate reconciliation?

Yes, reconciliation can be automated through accounting software and reconciliation tools that utilize advanced algorithms and data-matching techniques to reconcile financial transactions. Automation solutions, such as bank reconciliation software and ERP systems, can significantly reduce the risk of errors and the time required for manual processes. By integrating these tools with existing financial systems, businesses can achieve accurate reconciliations, real-time insights, and improved financial planning.

Can I do bank reconciliation on QuickBooks?

Yes, QuickBooks offers a bank reconciliation feature that allows users to efficiently reconcile their bank accounts by connecting directly to their bank and importing transactions.

The user-friendly interface simplifies the reconciliation process by automatically matching bank transactions to existing records in QuickBooks. In cases where unmatched records are found, QuickBooks provides an easy-to-use platform for manual intervention, ensuring that all transactions are accounted for and reconciled correctly.

What is account reconciliation in SAP?

Account reconciliation in SAP refers to the process of verifying and matching financial transactions and balances within the SAP (Systems, Applications, and Products) software suite, a widely-used enterprise resource planning (ERP) system.

The goal of account reconciliation in SAP is to ensure that the financial records within the system accurately represent the company's financial position and are in line with external financial statements, such as bank statements and credit card statements.

SAP offers various tools and modules designed to support and automate account reconciliation, including the Financial Accounting (FI) module and SAP S/4HANA Finance. These modules provide robust functionality for managing accounts payable, accounts receivable, general ledger, and other financial processes. By leveraging the capabilities of these SAP modules, businesses can automate the reconciliation process, reduce manual intervention, and minimize discrepancies in records.

The Bottom Line

To recap, here are the best account reconciliation software to try this year:

- ZarMoney — best of the best

- Sage Intacct — best for small businesses

- QuickBooks Online — best for entrepreneurs

- AutoRek — best for enterprises

- Blackline — best for automation

- Xero — best for midsize businesses

- Dolibarr — best free alternative