Today there are 83 different day trader tax software. We spent 67 hours comparing the top 50 to find the seven best you can use to file taxes as a day trader.

What is the Best Day Trader Tax Software?

- TurboTax Premium — best of the best

- TaxAct Premier — best for newbies

- H&R Block Premium — best for expats

- E-Smart Tax Deluxe Edition — best for families

- Jackson Hewitt — best for small businesses

- Sage Accounting — best for hobbyists

- FreeTaxUSA — best budget option

Our Verdict — Best Of The Best

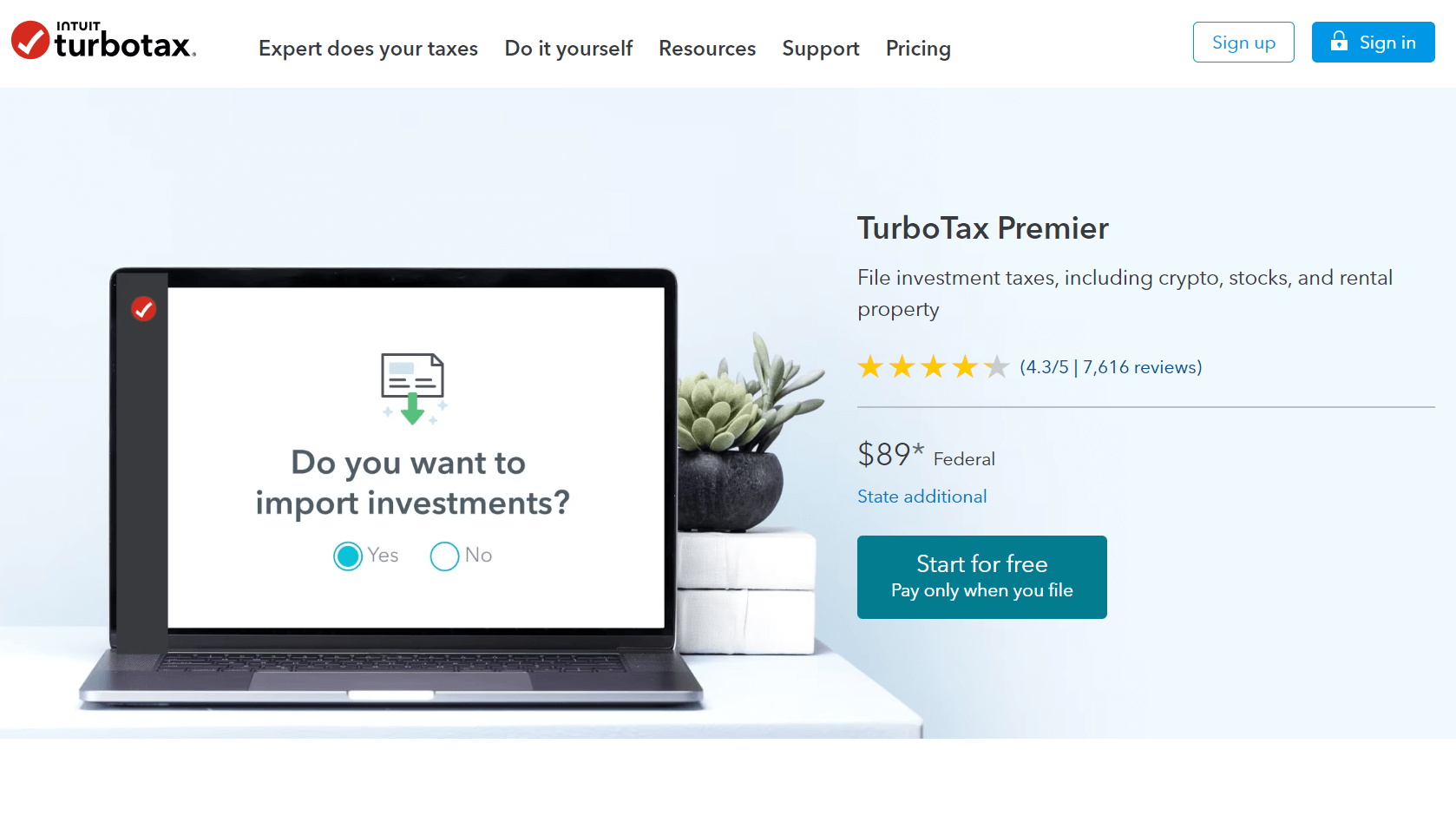

Price: Starts at $74

TurboTax Premium is a top-notch tax software for experienced day traders. We think it’s the best because of its seamless crypto and stock transactions imports, ability to unearth hidden deductions, and optional one-on-one assistance.

The Best Part:

It leaves no stone unturned. TurboTax Premium hunts down 450+ deductions and credits possibilities to maximize your tax refund.

The Worst Part:

Not for the casual trader. TurboTax Premium is packed with features that can be overwhelming for those with simpler tax needs.

Get it if you need a comprehensive solution to file taxes for your trades and dig up every possible deduction.

I recommend you start with TurboTax Premium free of charge, then pay just $89 to file your federal tax return.

(free sign up)

Best For

TurboTax Premium is best for active day traders who need an all-encompassing software to spend less money when filing taxes.

Top Features

- Crypto and stock transactions import. Import your stock and crypto trades effortlessly using spreadsheets or CSV exports from your broker.

- Deduction and credit discovery. TurboTax Premium digs deep like a pro treasure hunter to find every dollar to fatten up your tax refund.

- Personalized expert help. File your taxes with the help of a pro to avoid penalties and maximize your refunds (available for an extra fee) .

- Accuracy guarantee. Foot the bill to TurboTax if you ever get any IRS penalties for inaccuracies on your taxes.

- User-friendly interface. TurboTax Premium will enable anyone to file their taxes worry-free, even if they are total newbies.

Pricing

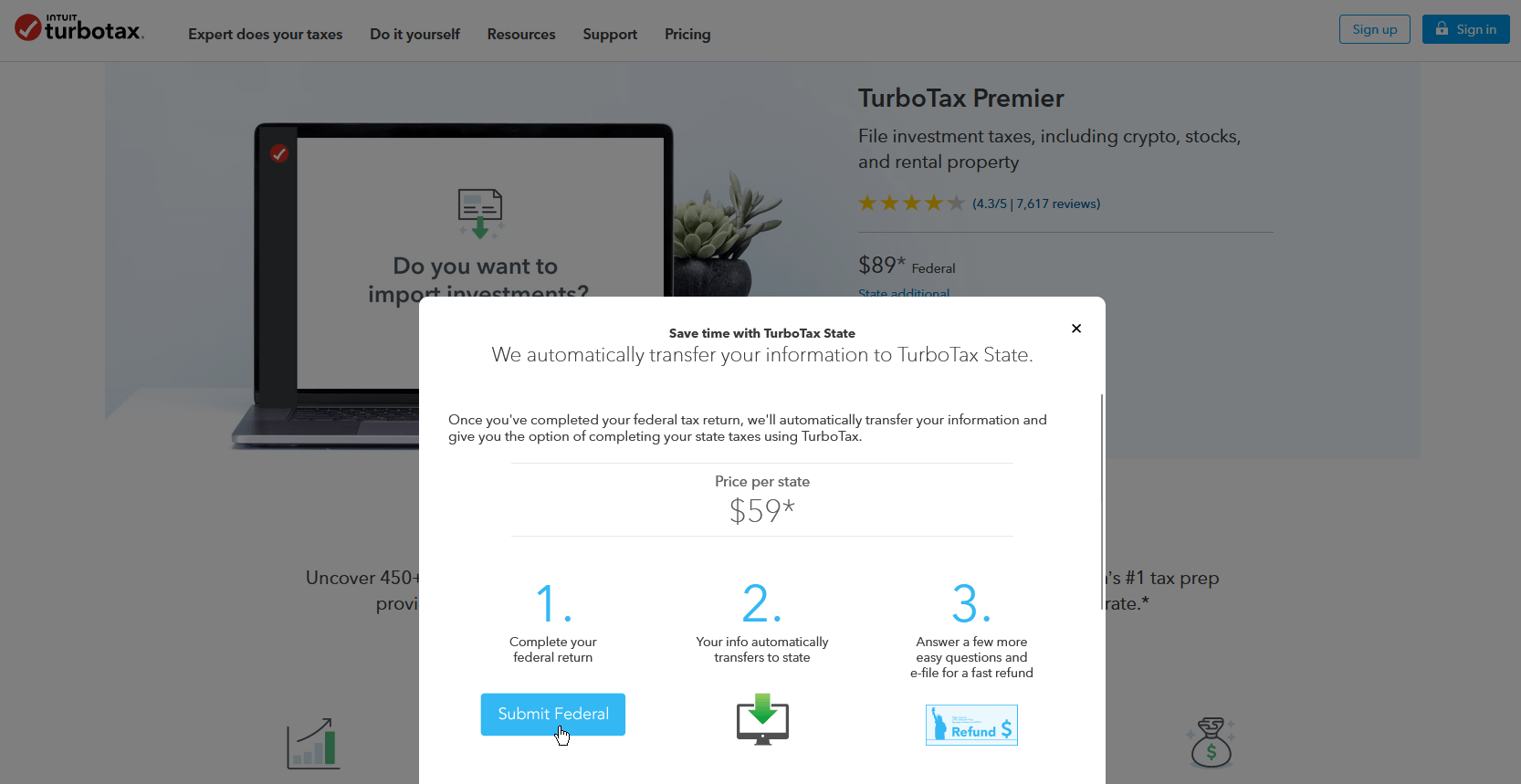

TurboTax Premium offers a single pricing plan:

TurboTax Premium: $89 one time fee for day traders who need a powerful software tool to easily file a federal tax return for their crypto and stock trades, with the option to file a state return for $59.

Try TurboTax Premium today with a free sign-up.

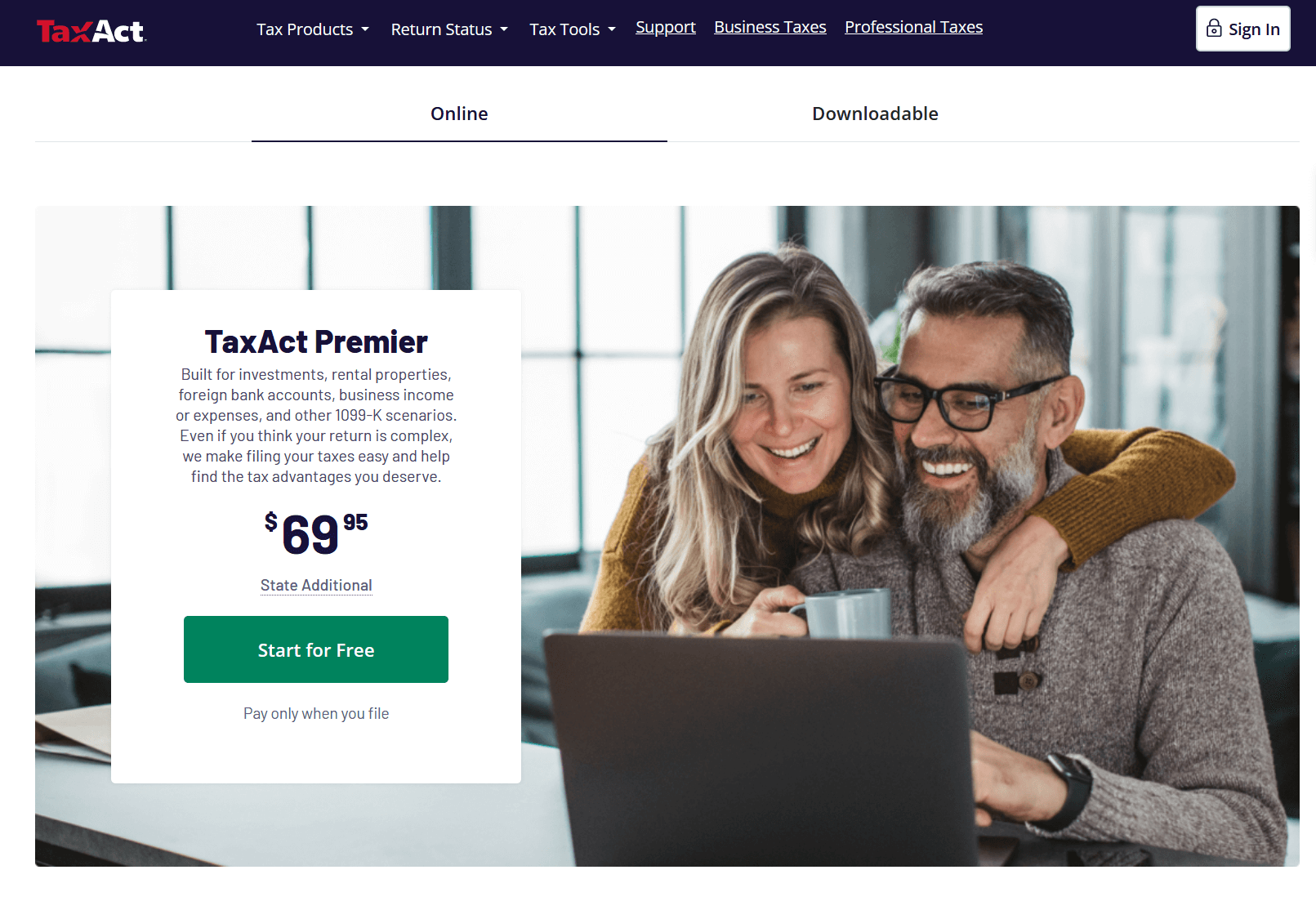

Our Verdict — Best For Newbies

Price: Starts at $69.95

TaxAct Premier is an easy-to-use tax software for newbie day traders. We think it’s the best for newbies because of its intuitive interface, robust stock data imports, and refund status tracking.

The Best Part:

Seamless data import. TaxAct Premier can import not only your trading history, but also data from W-2s, 1099s, and previous tax returns.

The Worst Part:

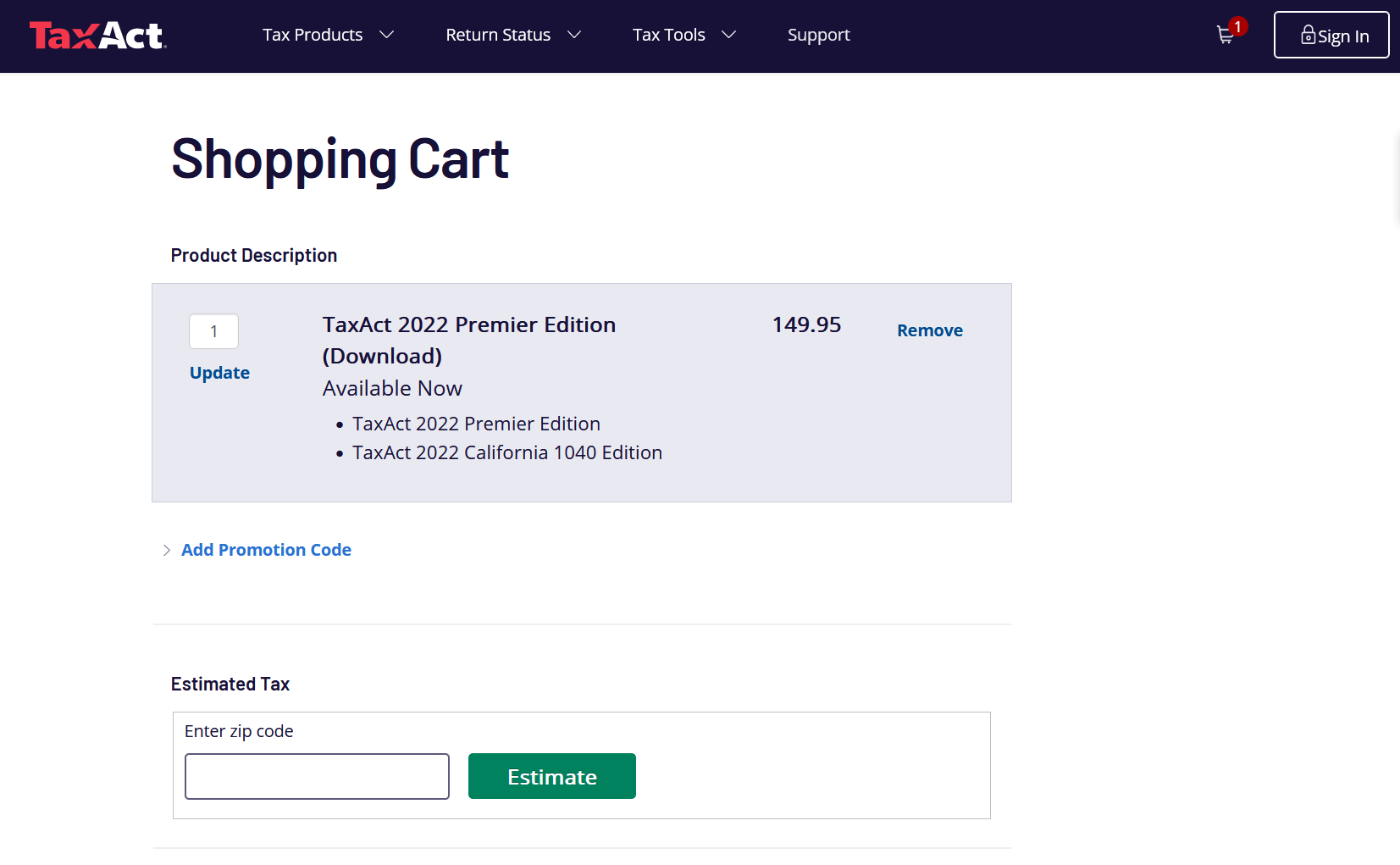

Pricey downloadable plan. TaxAct Premier's Downloadable plan is priced at more than double the cost of its Online plan.

Get it if you want a newbie-friendly tax software to file taxes for your day trades.

I recommend you start with TaxAct Premier free of charge, then file your federal taxes for $69.95.

(free sign up)

Best For

TaxAct Premier is best for newbie day traders who need an easy-to-use tax software with a solid accuracy guarantee.

Top Features

- Trading history import. Import your whole trading history using an Excel spreadsheet or CSV file from your broker, then let TaxAct Premier do the heavy lifting for you.

- Uncover hidden tax gems. Watch TaxAct Premier discover all possible credits and deductions for your federal and state taxes without lifting a finger.

- $100k accuracy guarantee. File your taxes with a smile on your face, knowing you’re backed with up to $100,000 from TaxAct Premier to cover any mistakes and penalties you may face.

- Free tax calculator. Sign up for a free TaxAct Premier account to calculate your taxes free of charge, before you spend a single dime.

- Great pricing. Enjoy their low prices when filing your federal and state taxes, when compared to TurboTax Premium and H&R Block Premium, for example.

Pricing

TaxAct Premier offers two pricing plans:

- Online: $69.95 for newbie day traders who need an easy-to-use tax solution with essential features to file a federal tax return and maximize refunds, with the option to file a state return for $54.95.

- Downloadable: $149.95 for newbie day traders who need a user-friendly solution to file a federal tax return, one or multiple state returns, and foreign bank financial report, with one free state return on TaxAct.

Try TaxAct Premier today with a free sign-up.

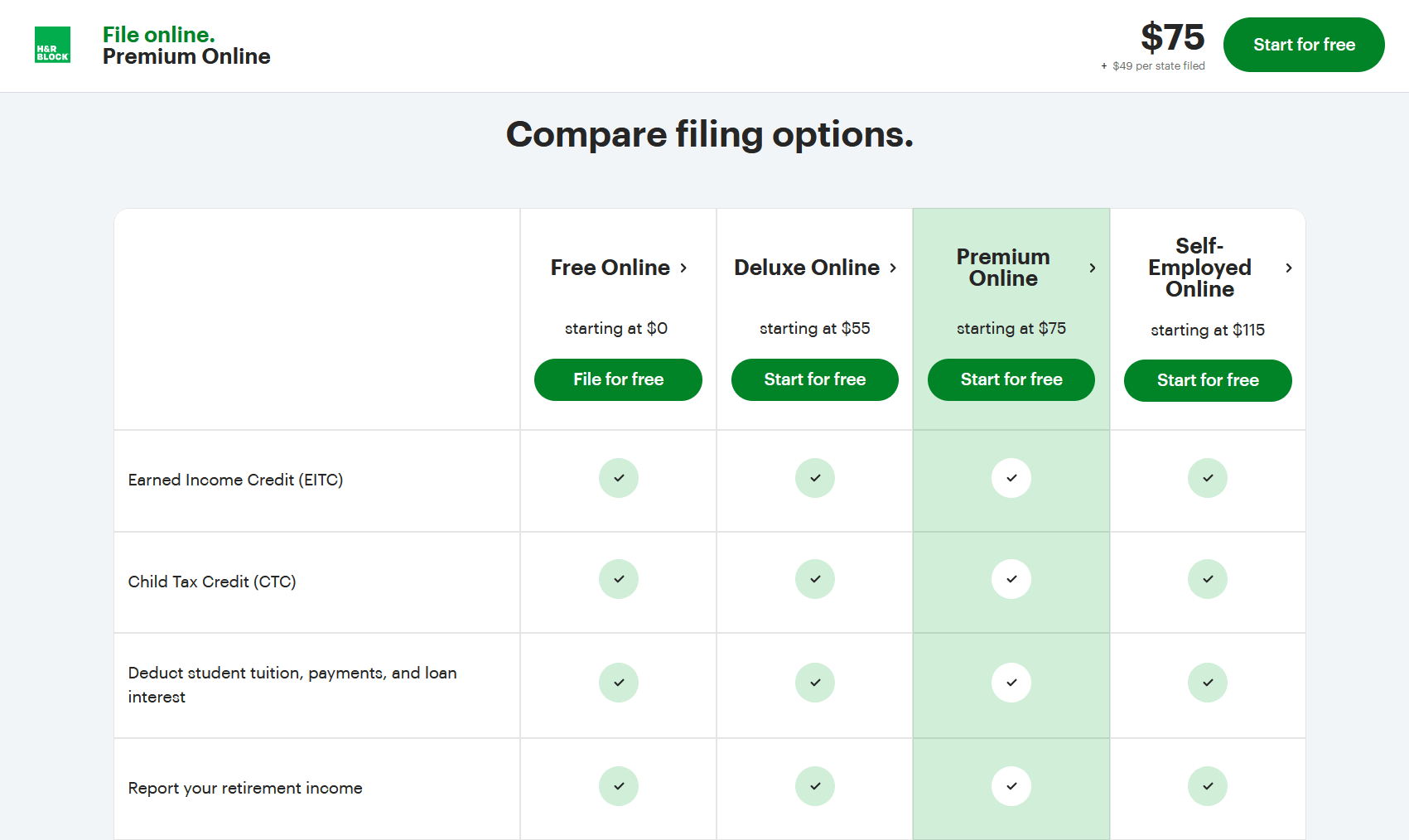

Our Verdict — Best For Expats

Price: Starts at $75

H&R Block Premium is a world-renowned tax software with unique features for expat day traders. We think it’s the best for expats because of its expat tax features, crypto tax support, and user-friendly interface.

The Best Part:

Robust features. H&R Block Premium provides all the necessary features for day traders who also invest in assets such as real estate, commodities, and infrastructure.

The Worst Part:

Extra charges for state or foreign bank returns. H&R Premium charges extra fees for filing state tax returns or Reports of Foreign Bank and Financial Accounts (FBAR).

Get it if you need a powerful tax solution with comprehensive features for US expats and special features for crypto traders.

I recommend you get started with H&R Block Premium free of charge, then file your federal tax for $75.

(free sign up)

Best For

H&R Block Premium is best for expat day traders who want a reliable solution to handle their foreign earned income taxes.

Top Features

- Expat-specific tax guidance. Get expert tax advice based on your individual situation if you’re an US citizen or Green Card holder living abroad.

- Dedicated FBAR tax filing. Report your foreign bank finances seamlessly, no matter which country you’re in.

- Foreign Earned Income Exclusion (FEIE). Exclude some of your foreign earned income from US taxation with the help of H&R Block’s experienced tax advisors.

- Crypto tax handling. Take the guesswork out of reporting cryptocurrency trades with crypto transaction imports and accurate gain & loss calculations.

- 100% accuracy guarantee. Get reimbursed for up to $10,000 over any IRS penalties or errors on your taxes calculations.

Pricing

H&R Block Premium offers a single pricing plan:

H&R Block Premium: $75 for expat day traders who need a comprehensive tax solution with reliable features to calculate and manage tax for trades in the US and abroad.

Try H&R Block Premium today with a free sign-up.

Our Top Three Picks

Here’s a quick summary of our top three picks:

- TurboTax Premium — best of the best

- TaxAct Premier — best for newbies

- H&R Block Premium — best for expats

Here’s a quick comparison of our top seven picks:

Tool | Entry Offer | Pricing |

|---|---|---|

TurboTax Premium | Free sign-up | Starts at $74 |

TaxAct Premier | Free sign-up | Starts at $69.95 |

H&R Block Premium | Free sign-up | Starts at $75 |

E-Smart Tax Deluxe Edition | Free sign-up | Starts at $65.95 |

Jackson Hewitt | None | Starts at $25 |

Sage Accounting | None | Starts at $10/mo |

FreeTaxUSA | Free sign-up | Starts at $7.99 |

Here are the top 50 day trader tax software we considered in this review:

- TurboTax Premium

- TaxAct Premier

- H&R Block Premium

- E-Smart Tax Deluxe Edition

- Jackson Hewitt

- Sage Accounting

- FreeTaxUSA

- Xero

- TradeLog

- GainsKeeper

- Drake Tax

- TaxSlayer Premium

- Cash App Taxes

- Liberty Tax Deluxe

- FreshBooks

- Wave Accounting

- Reckon

- 1040.com

- E-file

- Zoho Books

- QuickBooks Online

- Delirious Profit

- Tally Solutions

- QuickBooks Desktop

- Happay

- GnuCash

- Adminsoft

- Inv24

- Sage X3

- Adra Accounts

- Knowify

- plexxis

- AroFlo

- REALTRAC

- ZTimesheet

- Chase Software

- YourTradebase

- MyCostPro

- Cashbook

- Shopkeeper

- FinancialForce Accounting

- Activity HD

- ConnectBooks

- Access Financials

- Accounting Xpert

- MultiLedger

- Track Your Trades

- NolaPro

- Rerun

- AccountEdge

How do I keep track of day trading taxes?

Keeping track of day trading taxes can be challenging due to the complexity of tax laws and the high volume of trading activity. To ensure accurate accounting reports, day traders should use powerful tools such as accounting software packages that cater to the specific accounting requirements of financial markets. Popular tax programs like TurboTax, TaxAct, and H&R Block, offer specialized features to handle investment income, tax forms, and investment taxes relevant to traders.

Software for traders like Trader Workstation (provided by Interactive Brokers) and Lightspeed Trading can help traders record their actual trade history, including wash sales, which are subject to specific tax rules. Utilizing artificial intelligence and analytical tools, these programs can automatically calculate tax liability based on the trader's transactions across a wide range of assets.

Tax professionals, from companies such as Trader Tax Pros and TradeLog Services, specialize in handling the unique needs of active and professional day traders. They can assist with more complicated tax situations, including accounting for capital gains, rental property income, and corporate actions. By working closely with tax professionals, day traders can ensure they meet their tax obligations and avoid additional penalties.

Can day traders use TurboTax?

Yes, day traders can use TurboTax to manage their taxes. TurboTax offers advanced features designed to accommodate the unique tax needs of active traders, including handling investment income, investment taxes, and a range of market accounting. The software is capable of managing tax forms related to trading activity, such as capital gains and losses, and can help users understand the tax implications of their trades.

TurboTax also offers educational resources for long-term investors and day traders, including information about wash sale rules, tax implications of trading mutual funds, and how to account for rental properties. For users with more complex tax situations, TurboTax provides audit assistance and correspondence assistance, offering plenty of audit support in case of inquiries from tax authorities.

How do day traders manage taxes?

Day traders manage taxes by staying organized and keeping accurate records of their trading activity, which includes tracking their profits, losses, and wash sales. They can use accounting software packages and day trading platforms with integrated tax tools to automate the tax reporting process. It is also essential for day traders to understand key factors affecting their tax liability, such as the differences between short-term and long-term capital gains, as well as the tax implications of various financial instruments.

Working with tax professionals who specialize in day trading taxes can be invaluable, as they can provide guidance on tax planning strategies and ensure compliance with tax laws. Additionally, tax preparation services like H&R Block, Credit Karma Tax, and Liberty Tax can assist day traders in managing their tax obligations and filing their returns accurately and on time.

Can I write off trading losses?

Yes, day traders can write off trading losses to offset their investment income, reducing their overall tax liability. However, there are specific rules and limitations depending on the trader's classification (i.e., casual investor, pattern day trader, or professional trader) and the type of loss incurred (e.g., short-term or long-term capital loss).

In general, trading losses can be used to offset capital gains and up to $3,000 of ordinary income per year. Any remaining losses can be carried forward to future tax years. It's essential to be aware of the wash sale rules, which prevent taxpayers from claiming a loss on the sale of a security if they repurchase a substantially identical security within 30 days before or after the sale. Consulting with tax professionals or using specialized tax software can help day traders navigate these rules and ensure they properly write off their trading losses.

How can a day trader avoid high taxes?

Day traders can avoid high taxes by employing various tax planning strategies and being aware of the tax implications of their trading activities. These strategies include:

- Holding investments for longer periods. By holding investments for more than a year, traders can benefit from lower long-term capital gains tax rates compared to short-term capital gains rates that apply to assets held for less than a year.

- Tax-loss harvesting. This strategy involves selling losing positions to offset gains from other investments. By realizing losses, traders can reduce their overall taxable income. However, they must be cautious about wash sale rules to ensure they can claim the losses.

- Diversifying investments. By diversifying their portfolio across various asset classes and financial instruments, day traders can spread their risk and potentially reduce their tax liability.

- Retirement accounts. Contributing to tax-advantaged retirement accounts, such as traditional IRAs or 401(k)s, can reduce a trader's taxable income, leading to lower taxes.

- Consulting tax professionals. Tax professionals who specialize in day trading can offer guidance on tax planning strategies, helping traders minimize their tax liability while complying with tax laws.

- Record-keeping and organization. By maintaining accurate records of their trading activity and using accounting software, day traders can ensure they claim all relevant deductions and credits, ultimately reducing their tax burden.

- Choosing tax-efficient trading methods. Day traders can explore various trading methods, such as options or futures trading, which may have different tax implications than traditional stock trading. By understanding the tax consequences of different trading methods, traders can make more tax-efficient decisions.

By combining these strategies and staying informed about tax laws, day traders can potentially reduce their overall tax liability while remaining compliant with tax regulations.

The Bottom Line

To recap, here are the best day trader tax software to try this year:

- TurboTax Premium — best of the best

- TaxAct Premier — best for newbies

- H&R Block Premium — best for expats

- E-Smart Tax Deluxe Edition — best for families

- Jackson Hewitt — best for small businesses

- Sage Accounting — best for hobbyists

- FreeTaxUSA — best budget option