Today there are 72 different AI trading software to automate your crypto and stock market trading. We spent 80 hours comparing the top 50 to find the seven best you can use to increase your investment results.

What is the Best AI Trading Software?

- Trade Ideas — best of the best

- TrendSpider — best for day traders

- Stoic — best for crypto

- Tickeron — best for devs

- Algoriz — best for natural language trading

- QuantumStreet AI — best AI tech stack

- MetaStock — best for international investors

1. Trade Ideas

Our Verdict — Best Of The Best

Price: Starts at $118/month

Trade Ideas is the best tool for professional stock market investors to get real-time alerts, develop trading strategies, test investing hypotheses, and so on.

The Best Part:

All the right information in the blink of an eye. Trade Ideas translate massive amounts of data into visual graphs that tell you the whole story in a simple, easy to understand way, so you can make your decisions faster.

The Worst Part:

It’s limiting for foreign investors. You can only invest in U.S. and Canadian markets, and you only get feeds for stocks and options. It’d be great to use Trade Ideas’ capabilities for cryptocurrency, for example.

Get it if you’re a more experienced trader who wants a one-up against the market, by getting the right information before everyone else.

I recommend you get started for $118/month on the Standard plan, then upgrade to the Premium plan for more advanced features.

(15% off with the coupon ABC)

Best For

Trade Ideas is best for experienced stock and options traders. It focuses on stocks and options, so experienced traders can deep dive into the data, and come up with deep insights into market trends.

Top Features

- Make it your own. Trade Ideas is the most customizable AI investing app, and it’s super easy to understand. You’ll be ready to go within a few minutes.

- Understand risk and reward in the blink of an eye. Every time you hop into your Trade Ideas chart, the software will present you with “risk and reward” levels for buying specific assets, based on your settings and average buying behavior. Find the best opportunities quickly, and know what to expect in advance, without having to become a master of technical analysis.

- Stock racing. Watch 10 or 20 stocks simultaneously to compare their performance visually, over time. This visual representation makes it extra easy for you to get the full picture and know where to invest your money.

- Avoid uphill battles. With their “Compare Count” feature, you can get visual feedback of what strategy works best, in real time. As you see which strategy occurs more or less frequently, your decisions become clearer.

- Get your day trading going. With the Premium plan comes “Holly AI” aka Trade Ideas’ suggested entry and exit signals AI. Holly looks for statistical patterns, and coupled with their backtesting technology “Oddsmaker,” it lets you know which is the probable best time to enter or exit a trade.

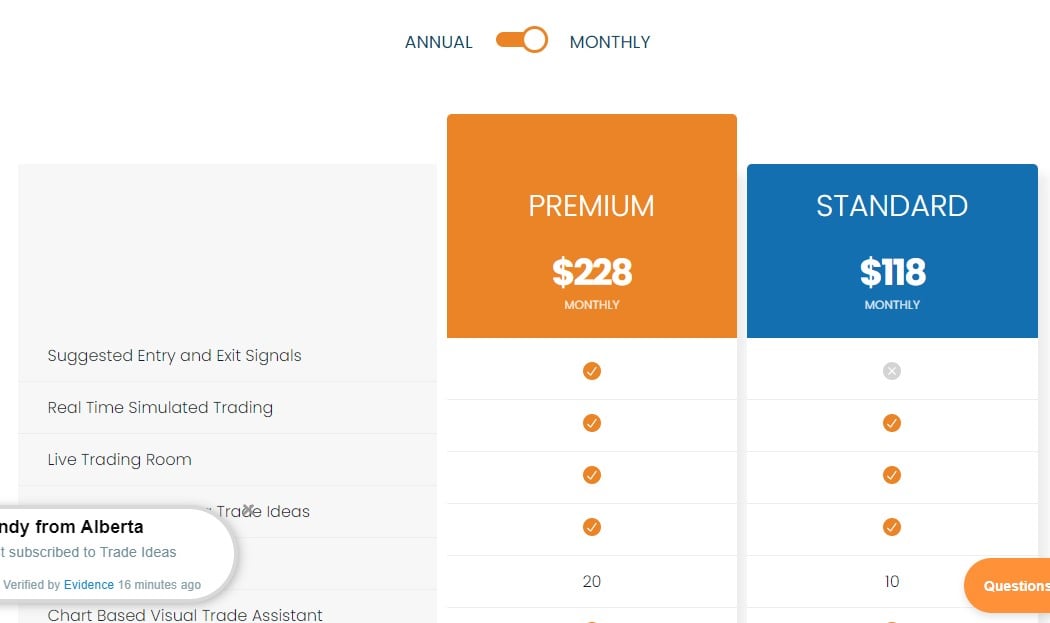

Pricing

Trade Ideas offers two pricing plans:

- Standard: $118/month for their basic features, like the visual trade assistant.

- Premium: $228/month for their advanced features, like suggested entry and exit signals.

Annual subscriptions provide up to 29% discount.

Try Trade Ideas for 15% off with the coupon ABC.2. TrendSpider

Our Verdict — Best For Day Traders

Price: Starts at $39/month

TrendSpider is one of the most versatile AI trading tools out there, and it keeps getting more and more popular among technical traders, day traders, swing traders and other high-frequency trading pros.

The Best Part:

It’s super flexible. TrendSpider has market feeds for many different assets, like US stocks, currencies, and digital assets, to name a few. You can set your custom alerts and automated technical analysis when specific movements happen, so you can spot and exploit market trends quicker.

The Worst Part:

There’s no “decision making” help for beginner traders. If you’re only beginning with technical indicators, this tool might feel a bit overwhelming.

Get it if you’re a day trader who wants to spot and exploit opportunities faster than the next trader.

I recommend you get started for $39/month on the Premium plan, then upgrade to the Elite Plan for $79/month.

(7-day free trial)

Best For

TrendSpider is best for the hands-on day trader who loves to spend time analyzing technical stock charts and indicators.

Top Features

- Simple backtesting. TrendSpider allows you to backtest your strategies over any time frame you want, be it 1 minute or several months. Pick your market, pick your assets… and you’re ready to run your test.

- Raindrop charts. TrendSpider has developed their own alternative to candlesticks, called “Raindrop Charts.” Along with the standard open, high, low and close prices, you also get price development and the VWAP (Volume Weighted Average Price). This is like candlesticks on steroids, that let you know about the trading volume during a given period. Now you’ll be able to find those bull market signals a lot easier.

- Find opportunities quicker than anyone else. TrendSpider helps you ride along with breakouts in several markets. If an asset breaks resistance, they’ll let you know. Set your own watchlists, turn on the smart alert system, and the software will let you know about breakouts, price touches, and bounce setups when they happen. The artificial intelligence also auto-detects trendlines, Fibonacci patterns, and candlestick patterns on multiple timeframes, on a single chart.

- Options Flow Scanner. This feature tracks directional trades like block trades or options sweeps, which can potentially point to massive directional bets from sharks. You get trade volume, expiration date, and strike prices on a whim. Their “unusual options scatter plot chart” shows current trades in a very unique way, making it a lot easier to find the big opportunities.

- Automated trend lines. Anyone who’s ever manually spotted the right anchors to create trend lines knows how painful it is. TrendSpider draws trendlines for you, with a single button click. Not only do you save time, but you also get a more accurate picture.

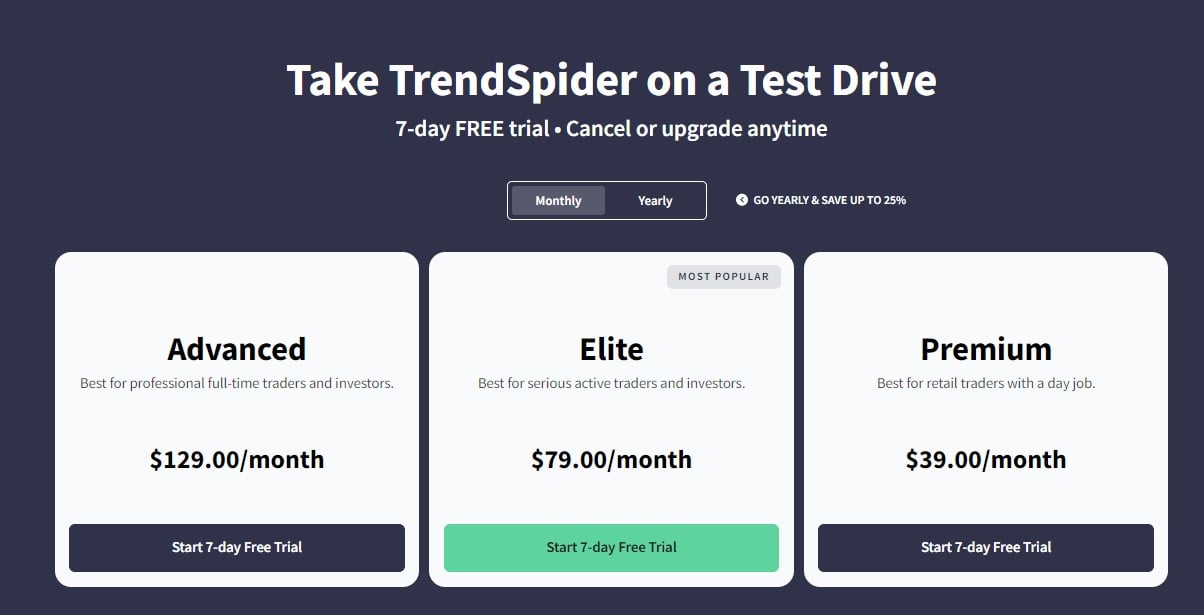

Pricing

TrendSpider offers three pricing plans:

- Premium: $39/month for their basic features, like multi-timeframe scan.

- Elite: $79/month for their advanced features, like intraday backtesting.

- Advanced: $129/month for even longer time frames and higher limits.

Annual plans provide up to 25% discount.

Try TrendSpider today with a 7-day free trial.

Our Verdict — Best For Crypto

Price: Starts at $108/year (equivalent to $9/month)

Stoic is a crypto trading bot for people who want to automate their trading based on hard data, instead of relying on emotional trading. Anyone from beginners to pros can benefit from Stoic’s daily portfolio rebalancing that links to your Binance account. Stoic has gone up by over 2,143% since March, 2020.

The Best Part:

Done-for-you. Stoic’s AI automatically manages and monitors your portfolio. The software will re-balance your portfolio daily, so you don’t have to worry about which assets to buy, hold, or sell. You also won’t have to manually enter or exit trades, or check if the market is bullish or bearish.

The Worst Part:

You got to pay for the management fees upfront. The minimum management fee is $108/year and the minimum deposit amount is $1,000 USD. If you’re investing $10,000 USD or more, you’ll pay a 5% management fee right out of your deposit. Every time you add more crypto assets to your Binance account, Stoic will charge the 5% fee again.

Get it if you want the closest you can possibly get to a true “set-and-forget” experience, and have an artificial intelligence bot do all the trading for you.

I recommend you get started for $9/month on the Starter plan, then upgrade to the plan that works for your portfolio size.

(starts at $108/year)

Best For

Stoic is best for anyone from beginner to professional traders who have a Binance account, and want a reliable AI trading bot to do all the dirty work for them.

Top Features

- It’s reputable. Stoic trades on Binance, which is probably the exchange with the highest reputation in crypto markets. This makes it the most reliable AI trader out of all the options out there. Stoic relies on Cindicator’s “Zero Trust Principles” and uses deep learning to reduce risks close to zero.

- Really close to “Set and forget.” Stoic manages and monitors your portfolio, so you’ll never need to have your eyes glued to a screen.

- Superb historic returns. Stoic has delivered +2,143% gains since March 2020, with over $100 million in assets on 15,000+ users’ accounts.

- It sifts the wheat from the chaff. Stoic uses a pre-selected portfolio of the top 30 cryptocurrencies, so it can automatically adjust your position with the highest performing coins out there, only.

- Low entry barrier. You can start with just $1,000 USD, and you’re ready to have your portfolio automatically managed by Stoic

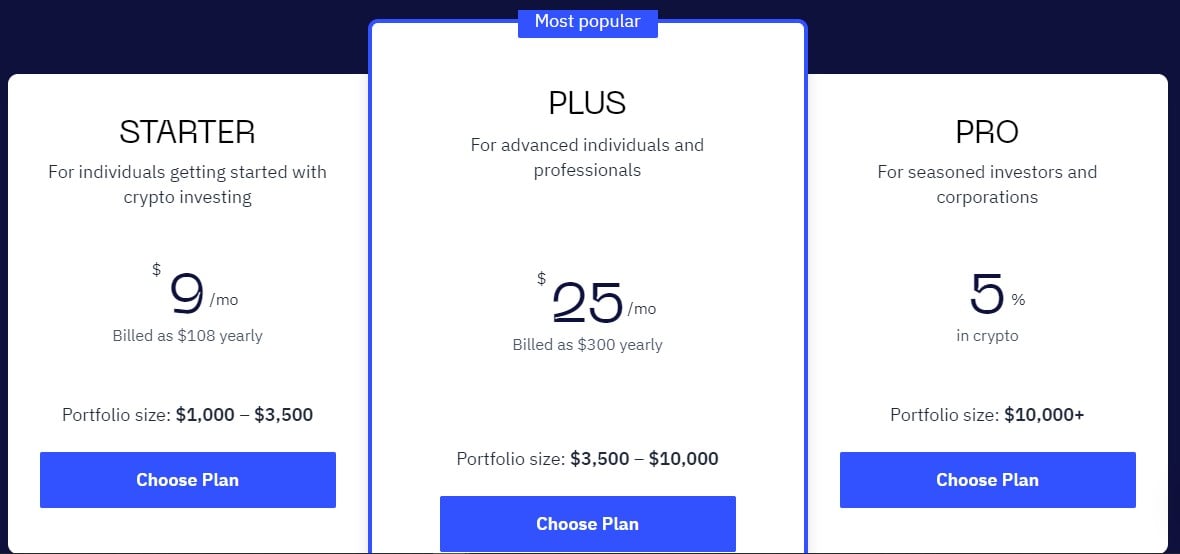

Pricing

Stoic offers three pricing plans:

- Starter: $108/year for portfolios between $1000 and $3,500.

- Plus: $300/year for portfolios between $3,500 and $10,000.

- Pro: 5% fee for portfolios of $10,000 and over.

Try Stoic by investing your first $1,000 USD.

Our Verdict — Best For Devs

Price: Starts at $108/year (equivalent to $9/month)

Tickeron is a great AI-driven trading platform that empowers devs and traders to make data-driven decisions. We think it’s the best for devs because of its scalability, API capabilities, and customizable strategies.

The Best Part:

Reliable scalability. Tickeron is designed with scalability and reliability in mind, with a great platform that can handle high-frequency trading, large volumes of data, and intense market conditions with minimal downtime or performance issues.

The Worst Part:

High costs. Tickeron's more advanced features and functionalities may come with a relatively high cost for individual devs.

Get it if you want a reliable and scalable AI trading software with a powerful API.

I recommend you get started with the free plan, then upgrade to the Intermedia Two plan for $180/month.

(free plan)

Best For

Tickeron is best for anyone who wants a reliable AI trading API.

Top Features

Dev-friendly API. Tickeron offers a great API that allows developers to integrate AI-powered trading capabilities into their own apps and systems.

Customizable strategies. You can easily customize Tickeron’s trading strategies to your preferences, risk tolerances, and market conditions.

Backtesting goodies. With Tickeron’s backtesting tools, you can evaluate the performance of your trading strategies using historical data, to help refine the rough edges.

Educational explosion. There are a ton of educational resources and tutorials for you to deepen your understanding of AI, machine learning, algorithmic trading, and more.

Great community. Share ideas, collaborate on projects, and exchange knowledge and experiences within Tickeron’s community.

Pricing

Tickeron offers three pricing plans:

- Free: Free for basic daily buy/sell signals.

- Intermediate One: $90/month for the basic AI package.

- Intermediate Two: $180/month for the full AI package.

Try Tickeron now with the free plan.

Our Verdict — Best For Natural Language Trading

Price: Starts at $29/month

Algoriz is an AI that allows you to quickly build, test, and automate trading strategies with natural language. We think it’s the best for natural language trading because of its simple “type and trade” approach, and powerful automation capabilities.

The Best Part:

Type and trade. Algoriz lets you build your trading strategies by typing your instructions in plain English, thanks to its natural language processing powers.

The Worst Part:

Not very beginner friendly. In order to fully leverage Algoriz’s capabilities, it’s better to have a good knowledge of the market.

Get it if you want the closest you can possibly get to a true “set-and-forget” experience, and have an artificial intelligence bot do all the trading for you.

I recommend you get started for $9/month on the Starter plan, then upgrade to the plan that works for your portfolio size.

(free plan)

Best For

Algoriz is best for anyone who wants to type in plain English and get their strategies all set up, with no coding.

Top Features

Powerful automation. Algoriz can fully automate your trading ideas and strategies, so you can skip all of that crazy monitoring.

Market sentiment. Get access to market sentiment data for stocks and cryptocurrencies, so you can make more informed decisions.

Multi-asset capabilities. Invest in Bitcoin, Ethereum, XRP, and many more.

Customized or DFY? You can customize your own algorithms or choose from a library of many pre-built strategies.

Manage your risks. Algoriz incorporates many risk management features so that your trading is always safe.

Pricing

Algoriz offers four pricing plans:

- Free: Free forever with all the stock trading essentials.

- Professional: $29/month for crypto and 5+ years of backtesting.

- Premium: $69/month for unlimited algorithms.

- Enterprise: Custom pricing for customized solutions.

Try Algoriz today with the free plan.

Our Verdict — Best AI Tech Stack

Price: Custom pricing

QuantumStreet AI is an investing powerhouse that works around the globe. We think it offers the best AI tech stack because of its proprietary algorithms, its IBM Watson-powered news analyzer, and its wide selection of tools.

The Best Part:

Powered by IBM Watson. QuantumStreet runs on the incredible IBM Watson for research, risk management, and opportunity finding.

The Worst Part:

Price transparency. There’s no pricing information on their website — you’ll have to email them first.

Get it if you want to invest with the finest AI trading tools in the market.

I recommend you get started by reaching out to QuantumStreet’s contact email.

(custom pricing)

Best For

QuantumStreet is best for anyone who enjoys paying a premium for cutting-edge technology.

Top Features

Proprietary algos. QuantumStreet is built on proprietary machine learning algorithms that analyze an immense amount of data, looking for investment opportunities.

Globalize your wealth. QuantumStreet offers solutions for investment and wealth management on a global scale — in virtually any country.

Performance is the name. By analyzing millions of news articles and other data sources, including financial and market data, you get more actionable insights before the market catches up.

Money where the mouth is. QuantumStreet manages over $5 billion in assets.

Customizable themes. QuantumStreet allows you to choose from a number of DFY themes, or to create your own themes quickly, so you see everything that matters quick ‘n’ easy.

Pricing

QuantumStreet AI has no public pricing information.

Try QuantumStreet AI by getting in touch.

Our Verdict — Best For International Investors

Price: Starts at $100/month

MetaStock is a powerful technical AI trading app that comes with global data coverage. We think it’s the best for international investors because of its global coverage, mind-blowing graphic system, and quality data.

The Best Part:

Global coverage. MetaStock is the place for every type of investor, including stocks, bonds, commodities, Forex, options, indices, ETFs… in any place in the world.

The Worst Part:

Too many add-ons. MetaStock has a bit too many options and way too many add-ons, which can add up pretty fast.

Get it if you want the closest you can possibly get to a true “set-and-forget” experience, and have an artificial intelligence bot do all the trading for you.

I recommend you get started with the free one-month trial.

(one-month free trial)

Best For

MetaStock is best for anyone wanting to invest overseas.

Top Features

- Reporting bliss. With over 300+ chart types and indicators, MetaStock offers the sweetest charting platform for technical analysts.

- Forecasting. MetaStock’s “Forecaster” tool uses pattern recognition to predict potential future price movements, to give you an early edge.

- Expert advisors board. MetaStock’s plans come with a selection of expert advisors to guide you through the investing maze.

- A+ customer support. MetaStock is well known for their excellent customer support, and how much they help traders along their investment journey.

- Real-time insights. With the Xenith module, MetaStock delivers real-time news and data, to help you stay always on top of what’s important around the world.

Pricing

MetaStock offers three pricing plans:

- MetaStock D/C (Daily Charts): Starts at $59/month, $745/year, or $499 one time, for end-of-day traders.

- Xenith: $165/month per region, or $1780/year, for real-time global financial news.

- MetaStock R/T (Real Time) + Xenith: $100/month or $1395 one time, and it requires a separate Xenith subscription, for real time traders who need a mix of tons of data and quick decisions.

Try MetaStock today with a free one-month trial.

Our Top Three Picks

Here’s a quick summary of our top three picks:

- Trade Ideas — best of the best

- TrendSpider — best for day traders

- Stoic — best for crypto

Here’s a quick comparison of our top seven picks:

Tool | Entry Offer | Pricing |

|---|---|---|

Trade Ideas | None | Starts at $118/mo |

TrendSpider | Free trial | Starts at $39/mo |

Stoic | None | Starts at $108/year |

Tickeron | Free plan | Starts at $60/mo |

Algoriz | Free plan | Starts at $29/mo |

QuantumStreet AI | Custom | Custom |

Metastock | None | Starts at $100/mo |

Here are the top 50 AI trading software tools we considered in this review:

- Trade Ideas

- TrendSpider

- Stoic

- Tickeron

- Algoriz

- QuantumStreet AI

- Metastock

- VectorVest

- ImperativeX

- Black Box Stocks

- Kavout

- Imperative Execution

- Interactive Brokers

- Infinite Assets

- Tech Trader

- eOption

- CryptoHero

- Zignaly

- Sigmoidal

- MetaTrader

- Jaaims

- Crypto Signals

- Numerai

- Trading Technologies

- Shrimpy.io

- GreenKey Technologies

- AI Stock Trading System

- MarketAxess

- Trality

- Intotheblock

- Pionex

- Auquan

- CoinRule

- Sentieo

- Two Sigma

- GalileoFX

- SeekingAlpha

- Capitalise

- RoboForex

- Springbox

- Stock Signals

- Auto Trading

- FRCST

- TradeSanta

- SmithBot

- Napbots

- B-cube.ai

- 3Commas

- CoinRule

- eToro

What Is AI Trading Software?

AI trading software is a computer program designed to predict market movements based on historical data. It’s usually used by retail investors to increase their chance of trading success — it’s easy, and you can use it too.

The idea behind using artificial intelligence as a stock trading tool is to use machine learning algorithms to analyze past price patterns and predict future performance. This allows traders to enter trades at the right moment, in order to get more profitable trades than average human traders. AI trading software is usually sold with a monthly subscription.

These crypto trading tools can be used for getting real-time data, alerts, and some of them will even do the algorithmic trading for you, like cryptocurrency trading bots, and stock trading bots that aim to let you beat the average crypto returns.

Many of them have advanced features like proprietary indicators, risk controls, proprietary approach to trading, stock market indicators analysis, rigorous backtesting, stock chart pattern recognitions, proprietary ratings, and much more.

Is automated trading profitable?

Automated trading tends to be profitable when you trade stocks using technical analysis. Technical analysis is the study of past price movements to predict short-term stock future trends and future performance.

The main advantage of automated artificial intelligence stock trading is that it allows traders to focus on other aspects of their business while leaving the tedious task of managing trades to the software, in order to increase their potential profit.

The whole idea is to lower the inherent risk in investing, with the right risk management practices and risk management rules, in order to get that extra edge and achieve quicker financial returns, based on the processing power of neural networks.

Can you automate stock trading?

Yes — just like you can automate video creation or use AI to create images, you can automate your stock trade portfolio management with some complex trading bots, like Stoic. Once you leverage these stock trading bot features, setting up your personal preferences and trading style, you could effectively automate your entire portfolio management.

It doesn’t matter if you’re a beginner trader, intermediate trader, a great retail trader, or an exceptional trader. With the right AI, you don't need to worry about making emotional mistakes when investing in stocks, especially when it comes to riskier activities, like swing traders or crypto traders, for example.

Does an auto trader work?

An auto trader works when you trade stocks automatically based on predefined rules. The advantage of using an auto trader is that they allow you to focus on other things while letting them do all the work for you.

However, you need to be careful about how much risk you want to take, with thorough risk analysis, and figuring out what kind of trading strategies you use in different financial markets.

If you’re going for bot trading, make sure you choose a safe trading bot algorithm, which has clear risk management capabilities. You can get crypto trading bots, arbitrage trading bots, paper trading bots, future prices trading bots, and all kinds of asset classes.

Some people save up so much time with algo trading they need to find a new hobby — how about creating AI art?The Bottom Line

Here are our top picks for the best AI trading software to try this year:

- Trade Ideas — best of the best

- TrendSpider — best for day traders

- Stoic — best for crypto

- Tickeron — best for devs

- Algoriz — best selection of DFY investment strategies

- QuantumStreet AI — best AI tech stack

- Metastock — best for international investors