Today there are 63 different mortgage CRMs. We spent 75 hours comparing the top 50 to find the seven best you can use to track your contacts and manage your mortgage business.

What is the Best Mortgage CRM?

- Whiteboard CRM — best of the best

- BNTouch — best for individual mortgage professionals

- Pipedrive — best for mortgage offices

- Jumbo — best for Salesforce users

- Surefire — best for sales

- Keap — best for small businesses

- HubSpot CRM — best for enterprise

Our Verdict — Best Of The Best

Price: Starts at $150/month per user

Whiteboard CRM the CRM of choice of the residential mortgage industry. We think it’s the best because of its outstanding communication automations.

The Best Part:

- SMS automation. Run marketing campaigns to obtain and retain leads and schedule text follow-ups and reminders to borrowers.

The Worst Part:

- It has no pricing plans for individual lenders. Whiteboard requires you to have a minimum of three users to get started with the entry-level plan.

Get it if you want a dedicated CRM for your mortgage business.

I recommend you book a demo with the WhiteBoard CRM team to explore how you can use the software for your mortgage business, then sign up for a monthly plan starting at $150/mo.

(free demo)

Best For

Whiteboard CRM is best for every mortgage business that wants a dedicated mortgage CRM to manage leads and transactions.

Top Features

- Seamless lead source importation. Sync and integrate data from tools such as LendingTree to centralize your CRM and efficiently track leads and manage sales.

- Automated SMS messaging. Stay top-of-mind with your customers 24/7 with automated text message scheduling.

- Integrate your loan origination system. Automate your workflows and streamline your processes with real-time data synchronization between your LOS and CRM.

- Industry-leading performance reporting. Outsmart your competition with detailed reports on your pipeline, loans funded, referrals, lead conversions, and more.

- iOS and Android communication apps. Stay connected with your team and clients while on the go to never miss an important meeting or deal.

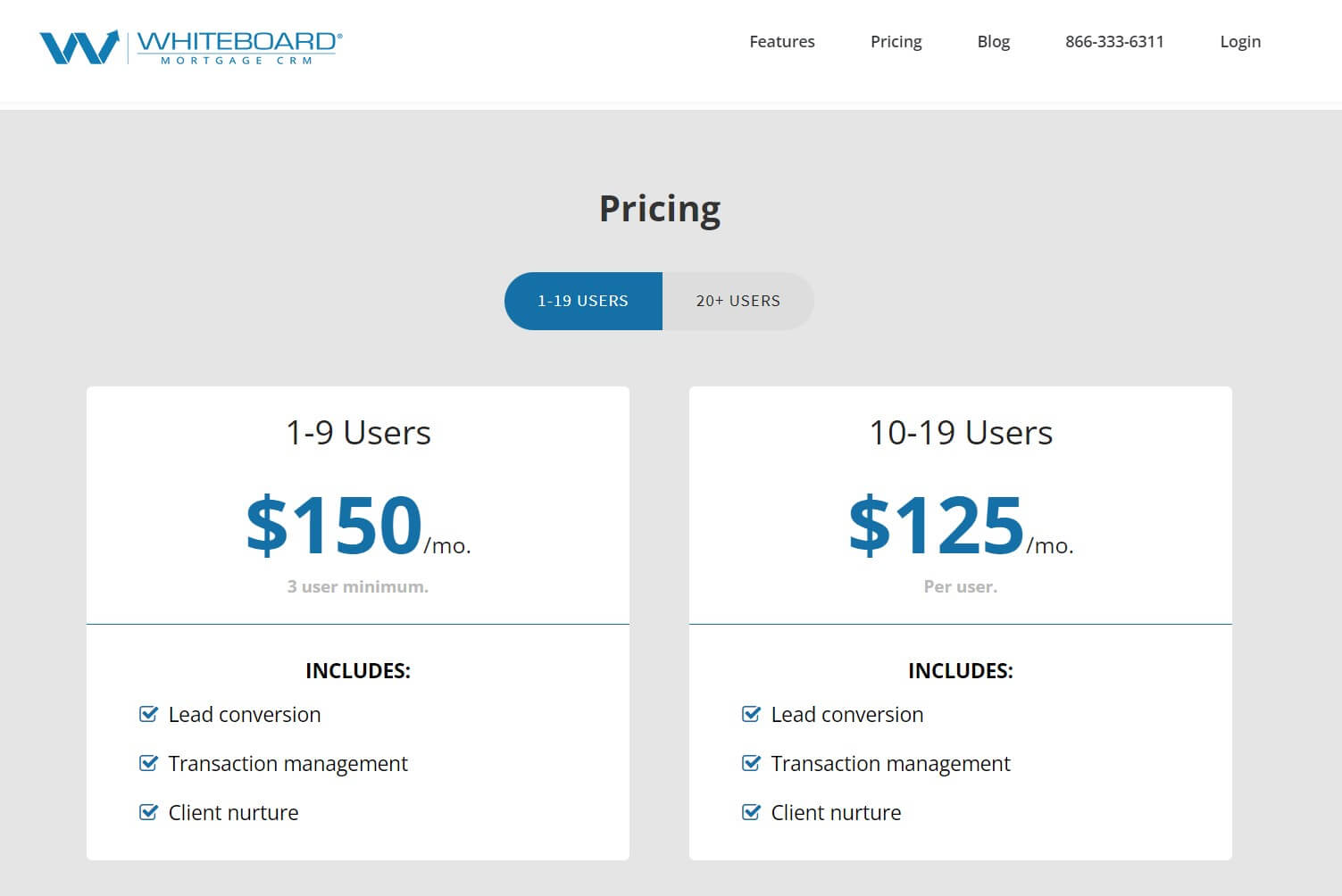

Pricing

Whiteboard CRM offers four pricing plans:

- 1-9 Users: $150/month per user, for mortgage businesses with 3 to 9 employees looking for a CRM to convert leads, manage transactions, and manage clients.

- 10-19 Users: $125/month per user, for mortgage businesses with 10 to 19 employees looking to get a CRM for transactions as well as lead conversion and management.

- 20+ Users: $100/month per user, for mortgage businesses and enterprises looking for a dedicated mortgage CRM solution to manage transactions and leads.

- Enterprise: $100+/month per user, for enterprises and mortgage businesses who want dedicated CRM onboarding help and tailored integrations for their businesses.

Try Whiteboard CRM today with a free demo.

2. BNTouch

Our Verdict — Best For Individual Mortgage Professionals

Price: Starts at $148/month

BNTouch is a growth-focused mortgage CRM. We think it’s the best for individual mortgage professionals because of its time-saving features.

The Best Part:

- Premade templates for email campaigns. Skip writer's block with over 180+ email templates for your mortgage marketing campaigns.

The Worst Part:

- Slow and rough user interface. BNTouch’s user experience and interface could definitely use some improvement.

Get it if you want a growth-focused mortgage CRM that'll help you convert leads with ease.

I recommend you request a demo with the BNTouch team, then sign up for the Individual plan at $148/mo to access powerful growth and marketing CRM features.

(free demo)

Best For

BNTouch is best for mortgage loan officers who want a comprehensive CRM to manage leads and bring in sales.

Top Features

- Voice, video, and text marketing automation. Send out automated marketing communication to your potential borrowers' phones and convert more leads.

- Pre-configured email marketing templates. BNTouch gives you access to a library of 180+ mortgage-specific templates for your email sequences and campaigns, so you never get stuck on what to say next.

- Digital loan management dashboard. Centralize your loan documentation and borrower management in one dashboard.

- Refinance opportunity reminders. Reach out to eligible clients for refinancing opportunities with BNTouch’s actionable tap-to-call emails.

- Team performance reporting. Track your team's progress and identify possible areas of improvement for sales, marketing, or communication.

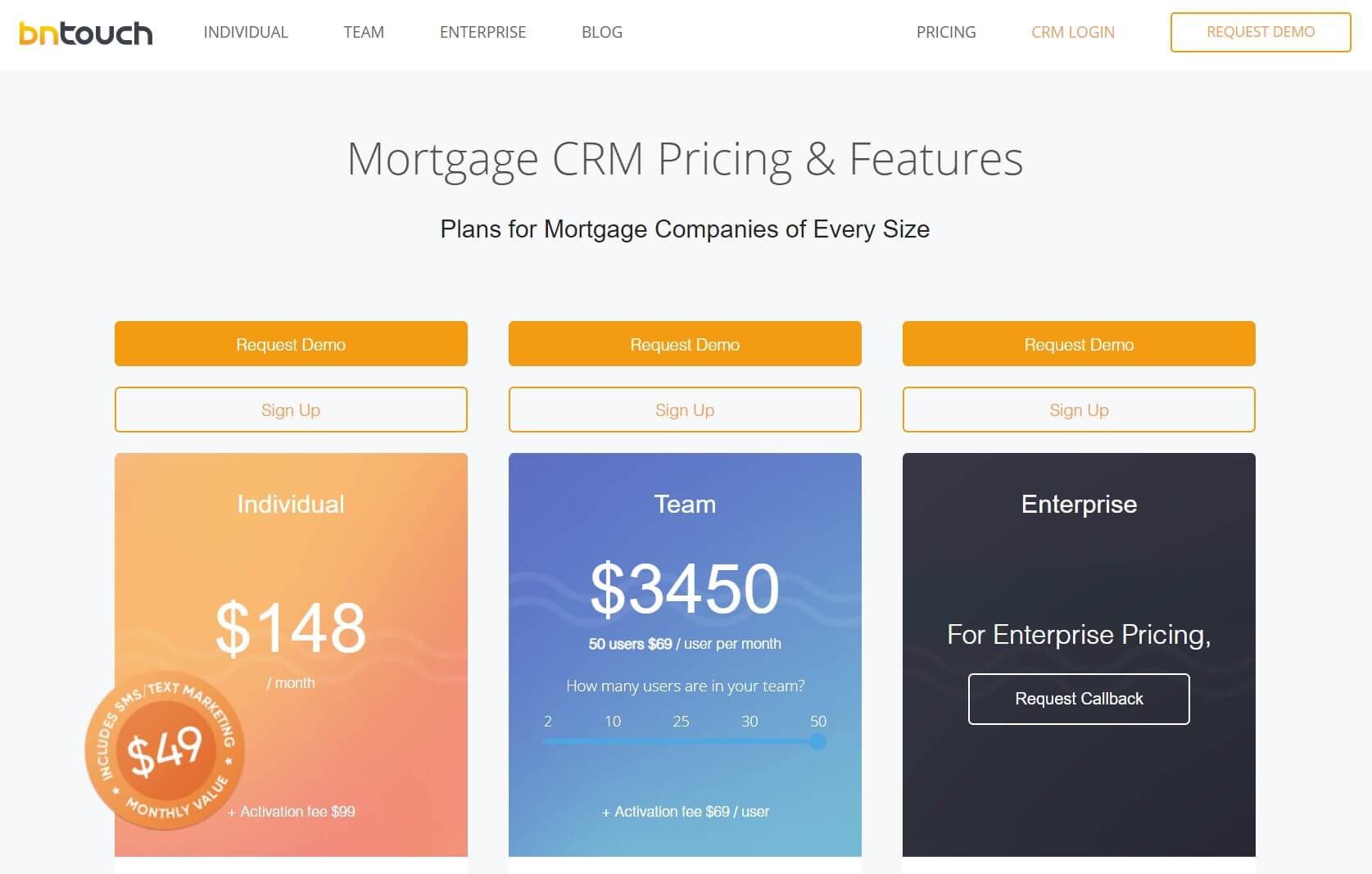

Pricing

BNTouch offers four pricing plans:

- Individual: $148/month for individual loan officers who want a comprehensive mortgage CRM solution.

- Team for 2-5 Users: $79/user/month for mortgage companies who want a dedicated mortgage CRM to manage up to 2500 contacts for up to 5 users.

- Team for 6-50 Users: $69/user/month for mortgage companies who want a powerful mortgage CRM for up to 2500 contacts per user.

- Enterprise: Custom pricing, for mortgage enterprises looking for full contact management and sales features as well as training and team onboarding options to manage unlimited contacts.

Try BNTouch today with a free demo.

3. Pipedrive

Our Verdict — Best For Mortgage Offices

Price: Starts at $19.90/month

Pipedrive is a versatile, world-renowned business CRM. We think it’s the best for mortgage offices because of its enterprise-level features.

The Best Part:

- Industry-leading sales features. Pipedrive provides you with reporting, lead generation, marketing, and onboarding features to help you have a blast managing your sales pipeline.

The Worst Part:

- It's not dedicated to mortgage management. Pipedrive works as an outstanding CRM for all types of businesses but lacks some specialized mortgage features.

Get it if you want a powerful sales-based CRM for your mortgage office.

I recommend you start out with the free 14-day trial, then sign up for the Professional subscription at $59.90/mo per user to get advanced CRM features and start closing deals.

(14-day free trial)

Best For

Pipedrive is best for mortgage offices that want a more efficient way to bring in sales and manage leads.

Top Features

- Smart document management. Streamline your documentation and autofill documents using Pipedrive’s data.

- Lead generation add-on. Engage your website visitors with live chat and chatbot functionalities and get access to over 400 million prospective leads.

- Non-stop customer support. Get live chat support, no matter what time it is.

- User-friendly interface. Enjoy an intuitive dashboard as you get prepared for the next deal or work on your documentation.

- Affordable starting price. Start enjoying the perks of having a CRM for only $19.90/mo per user with the Essential plan.

Pricing

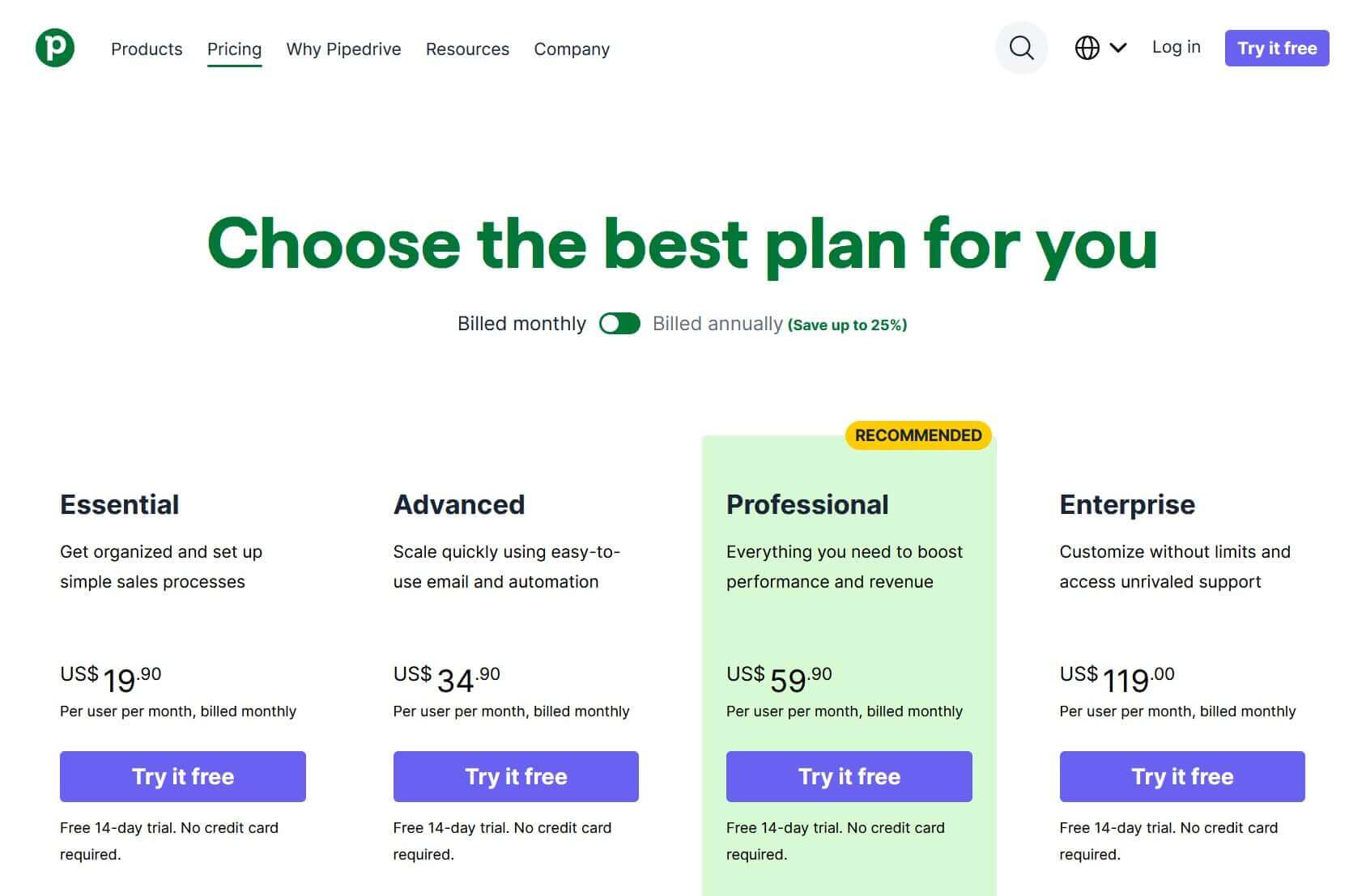

Pipedrive offers four pricing plans:

- Essential: $19.90/month per user for mortgage loan officers or brokers looking to start managing and setting up simple sales processes.

- Advanced: $34.90/month per user for mortgage offices and loan officers that want to run email marketing campaigns and manage sales leads.

- Professional: $59.90/month per user for mortgage offices and lenders that want access to full sales, marketing, reporting, and documentation features.

- Enterprise: $119.90/month per user for mortgage offices and enterprises that want to set up up to 100 active automation workflows and get access to heightened security features.

Annual plans provide up to a 25% discount.

Try Pipedrive today with a free 14-day trial.

Our Top Three Picks

Here’s a quick summary of our top three picks:

- Whiteboard CRM — best of the best

- BNTouch — best for individual mortgage professionals

- Pipedrive — best for mortgage offices

Here’s a quick comparison of our top seven picks:

Tool | Entry Offer | Pricing |

|---|---|---|

Whiteboard CRM | Free demo | Starts at $150/mo |

BNTouch | Free demo | Starts at $148/mo |

Pipedrive | 14-day free trial | Starts at $19.90/mo |

Jungo | Free demo | Starts at $119/mo |

Surefire | Free demo | Starts at $150/mo |

Keap | 14-day free trial | Starts at $189/mo |

HubSpot CRM | 14-day free trial | Starts at $20/mo |

Here are the top 50 mortgage CRM tools we considered in this review:

- Whiteboard CRM

- BNTouch

- Pipedrive

- Jumbo

- Surefire

- Keap

- HubSpot CRM

- Velocify

- Zendesk Sell

- Streak

- Shape CRM

- MyCRM Dashboard

- Insightly

- Cimmaron

- Zoho CRM

- Zendesk Suite

- Web+Center

- Volly

- Unify CRM

- SolarWinds Service Desk

- Soffront CRM

- Salesnet CRM

- Salesforce Sales Cloud

- Pulse Mortgage CRM

- NICE CXone

- Mortgage Magic

- Mortgage iQ

- MLO Shift

- LeadSquared

- LeadMaster

- HES

- Help Scout

- GoMax

- Freshdesk

- Five9

- EngageBay

- DYL

- Doorr

- DigiFi

- Commence

- ClickPoint

- BluMortgage

- Top of Mind Surefire

- TeamSupport

- SimpleNexus

- Salesflare

- Podio

- Nutshell

- LoanLogics

- InStream

What to look for when buying Mortgage CRM?

- Ability to manage referral partners and real estate agents effectively

- Tools to streamline and track marketing efforts

- Customer relationship management features for nurturing leads

- Tools to capture and manage potential clients

- Tracking of the entire customer journey and sales cycles

- Tools to streamline the mortgage sales process

- Seamless integration with existing mortgage software and tools

- Conversion rate analytics

- Automation of repetitive tasks

- Support for alternative marketing channels, like direct mail

- Features to encourage referral business

- Surveys to measure customer satisfaction

- Advanced customer segmentation, to maintain constant contact

- Ability to set up and manage drip campaigns

- Ability to add additional users

- Integration with the loan origination process

- Customizable dashboards for extra flexibility

- Automation of administrative tasks

The Bottom Line

To recap, here are the best mortgage CRMs to try this year:

- Whiteboard CRM — best of the best

- BNTouch — best for individual mortgage professionals

- Pipedrive — best for mortgage offices

- Jumbo — best for Salesforce users

- Surefire — best for sales

- Keap — best for small businesses

- HubSpot CRM — best for enterprise