Today there are 63 different private equity CRMs. We spent 86 hours comparing the top 50 to find the seven best you can use to track deals and keep tabs on the companies in your portfolio.

What is the Best Private Equity CRM?

- Close — best of the best

- DealCloud — best for investment companies

- 4Degrees — best for building relationships

- Affinity — best for automation

- Dynamo CRM — best for portfolio analysis

- Salesforce — best for enterprises

- Altvia — best for due diligence

1. Close

Our Verdict — Best Of The Best

Price: Starts at $29/month per user

Close is one of the most powerful CRM softwares in the world. We think it’s the best private equity CRM because of how much time it saves with its features.

The Best Part:

- It’s a time saving tool. Close’s extensive communication features, along with its automations, and sales tools, like the power dialer, will allow your team to spend more time closing private equity deals, and less time “trying to figure stuff out”.

The Worst Part:

- No QuickBooks integration. QuickBooks is the accounting software of choice of so many companies out there… But you can’t integrate it directly with Close. You’ll need Zapier, Make, or something to make it work.

Get it if you get a ton of leads every month from multiple channels, and want to keep them moving down your sales funnel.

I recommend you get started with the Startup plan for $59/month.

(14-day free trial)

Best For

Close is best for private equity firms who want close PE deals faster.

Top Features

- All communication in the same place. Close lets you call, text, and email, all from the same dashboard — and you can even automate them, based on each lead’s behavior.

- Deal flow origination. Close helps you segment all of your leads, so you know where they come from… and then, you can communicate with the right message, every time.

- Sales operations, DFY. Close can save you time and money by setting up and managing the dream marketing and sales stack for your business — with custom integration, syncing, sales training, and a lot more (custom pricing).

- Quicker connection. With the help of Close’s Power Dialer, which automatically calls through lead lists and screens out busy tones, answering machines and more, Close can get your sales reps on the phone with a lead in as little as 3 seconds.

- Don’t pay for moving. Close will migrate all the data from your existing CRM, within one week, for no charge. They’ll even follow up to make sure everything’s running smoothly.

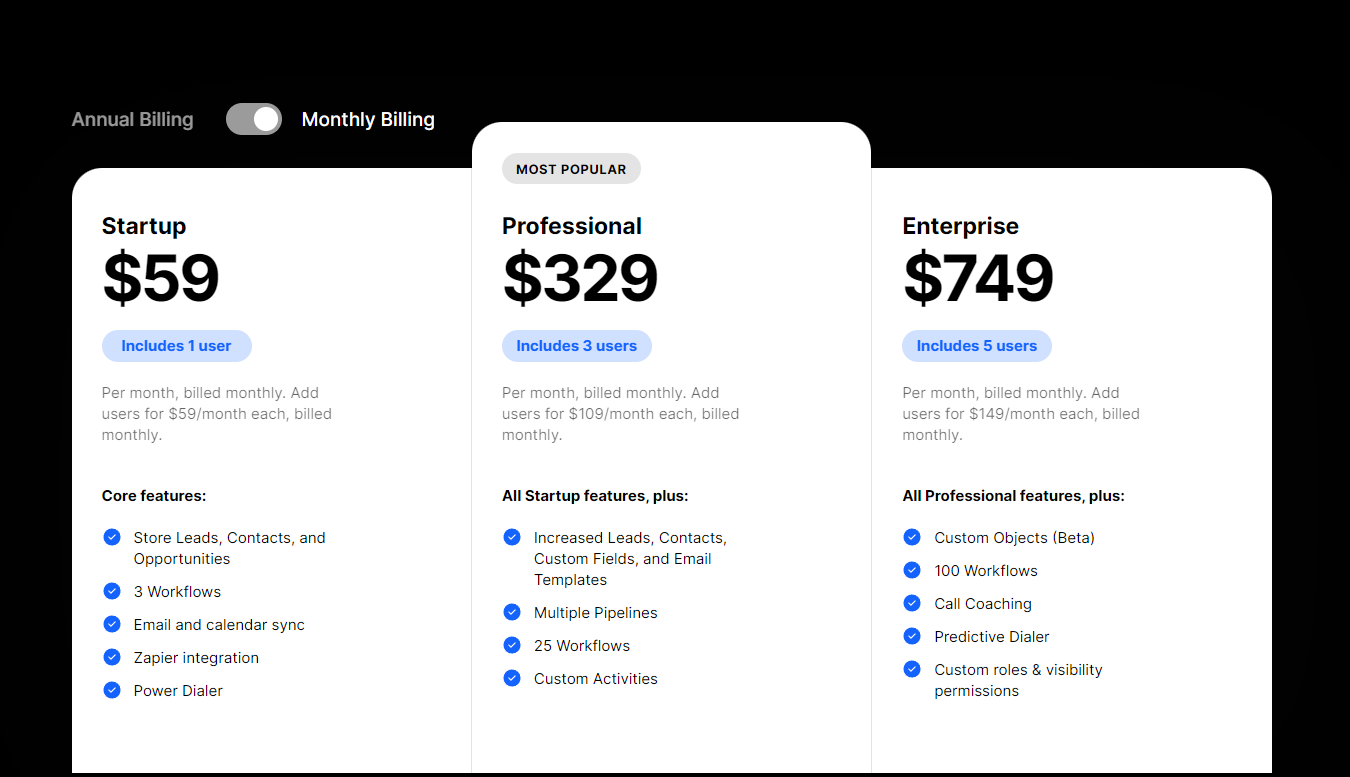

Pricing

Close offers three pricing plans:

- Startup: $59/mo for a single user and up to three sequences.

- Professional: $329/mo for three users and up to 25 sequences.

- Enterprise: $749/mo for five users, up to 100 sequences, and predictive dialer.

Annual subscriptions provide up to 17% discount.

Try Close today with a free 14-day trial.

2. DealCloud

Our Verdict — Best For Investment Companies

Price: Custom

DealCloud is a sophisticated, all-inclusive private equity CRM. We think it’s the best for investment companies because of its large list of third-party app integrations.

The Best Part:

- Industry-leading data integrations. DealCloud enables you to sync data from top third-party database tools such as FactSet, PitchBook, and Preqin.

The Worst Part:

- Basic email builder. DealCloud’s email marketing features are a bit limited when compared to competitors.

Get it if you want a comprehensive private equity CRM that will adapt to your business’ needs.

I recommend you schedule a demo with DealCloud to figure out a custom plan for your business.

(free demo)

Best For

DealCloud is best for private equity investors who want a powerful CRM to close more deals and save time while managing their relationships.

Top Features

Fundraising management. Manage fundraising processes, track investor commitments, and monitor fundraising progress in real-time.

Custom reporting and analytics. Generate custom reports and analytics to track all of your most important business KPIs from a single dashboard.

Mobile app for iOS and Android. Keep deals moving while on the go. Manage your calendar, contacts, and tasks using DealCloud’s sleek mobile app.

Conflicts management. Identify potential conflicts of interest and manage them effectively to maintain trust and credibility with investors and other stakeholders.

Dedicated training hub. Access tens of crash courses on DealCloud University to help you get the best out of your CRM, with free enrollment for everyone.

Pricing

DealCloud employs a custom pricing model.

Try DealCloud today with the free demo.

3. 4Degrees

Our Verdict — Best For Building Relationships

Price: Custom

4Degrees is a ground-breaking private equity CRM with powerful tools for warm outreach. We think it’s the best for relationships because of its AI powers.

The Best Part:

- AI-powered relationship management. Receive real-time notifications when a connection changes jobs, tweets, or is in the news.

The Worst Part:

- Weak email marketing features. 4Degrees lacks common email marketing features such as bulk emailing and email merging.

Get it if you want a cutting-edge CRM to develop authentic relationships.

I recommend you book a one-on-one Private Equity demo with 4Degrees.

(free demo)

Best For

4Degrees is best for private equity investors who want a solid CRM to build lasting business relationships and find new opportunities.

Top Features

Personalized warm outreach. Discover the strongest link between your team members and potential contacts, helping you build genuine connections.

State-of-the-art Chrome extension. 4Degrees’ extension lets you know which team members are connected to a LinkedIn profile you visited, who in your team is best positioned to introduce you to a lead when you visit a company’s website, and which interactions you’ve previously had with a Gmail lead.

Work and travel power up. Get an email with a full list of relevant potential connections when you visit a new city or country.

Third-party data sourcing. Integrate database platforms such as PitchBook and Crunchbase to feed your contacts with real-time data.

Customizable reporting. Track your investment stages with a flexible deal tracking view and use that to uncover unique insights about your leads.

Pricing

4Degrees employs a custom pricing model.

Try 4Degrees today with the free demo.

4. Affinity

Our Verdict — Best For Automation

Price: Custom

Affinity is a strong private equity CRM for portfolio and deal management. We think it’s the best for automation because of its automation features.

The Best Part:

Sleek interface. Affinity provides what’s probably the most eye-pleasing interface design in the entire market.

The Worst Part:

Steep learning curve. Affinity can feel a little overwhelming at first. There are many features and variables, and some integrations are difficult to manage.

Get it if you want a sleek CRM with efficient relationship intelligence and portfolio management features.

I recommend you submit a demo request to get started.

(free demo)

Best For

Affinity is best for private equity investors who want a powerful CRM to automate their lead management while building lasting relationships.

Top Features

Automated data entry. Capture and input data automatically from emails, calendar interactions, and other sources with Affinity’s relationship intelligence.

Streamlined network visibility. Gain visibility into your network relationships to identify potential deal opportunities and referral sources.

Smart pipeline management. Keep a full pipeline with the automatic deal sourcing feature.

Get integrated. Use Affinity along with your current CRM and marketing solutions such as Salesforce, HubSpot, and Mailchimp.

All roads lead to Rome. You can access Affinity from many other tools, with Affinity’s extensions for Chrome, Outlook, Zoom, and mobile.

Pricing

Affinity employs a custom pricing model.

Try Affinity today with the free demo.

Our Top Three Picks

Here’s a quick summary of our top three picks:

- Close — best of the best

- DealCloud — best for investment companies

- 4Degrees — best for building relationships

Here’s a quick comparison of our top seven picks:

Tool | Entry Offer | Pricing |

|---|---|---|

Close | 14-day free trial | Starts at $29/mo |

DealCloud | Free demo | Custom |

4Degrees | Free demo | Custom |

Affinity | Free demo | Custom |

Dynamo CRM | Free demo | Custom |

Salesforce | 30-day free trial | Starts at $300/year |

Altvia | Free demo | Custom |

Here are the top 50 private equity CRMs we considered in this review:

- Close

- DealCloud

- 4Degrees

- Affinity

- Dynamo CRM

- Salesforce

- Altvia

- eFront

- Navatar Edge

- Xpedition Private CRM Accelerator

- Microsoft Dynamics 365

- Backstop Solutions

- Clienteer

- SalesPage

- Satuit

- HubSpot

- SugarCRM

- Zoho CRM

- Pipedrive

- Dialllog

- monday sales CRM

- nTask

- Attio

- EquityTouch

- Efront

- Relevant Equity Works

- MRI Real Estate Private Equity Software

- Hitachi Solutions

- Digiterre Communica

- PE Front Office CRM

- Navatar Edge

- InvestGlass

- Totem VC

- Edda

- Davigold

- Dealfabric

- Copper

- FounderSuite

- Insightly

- Proseeder

- Streak

- Trello

- Vantage

- Zapflow

- Flowlie

- Finta

- folk

- Perfona

- Evolved Metrics CRM

- Pinnakl CRM

What to look for CRM in private equity?

- Ability to work as a single source of truth for making informed decisions, based on real sales data

- Tools that reduce manual data entry

- Ensure all portfolio company data is easily accessible

- Look for customer relationship management platforms that have private equity industry specific features

- Tools to build investor relationships

- Seamless integration capabilities with third-party apps

- Evaluate if the CRM of your choice supports both venture capital firms or financial services firms' needs

- Find cloud-based CRMs for better accessibility

- Workflow automation that optimize your workflow

- Consider software solutions that provide a competitive edge on sales

- Features to get deeper insight into customer behavior

- Contact management tools with detailed investor communication history

- Integration across systems for a cohesive data environment

- Tools that facilitate networking and referrals

The Bottom Line

To recap, here are the best private equity CRMs to try this year: